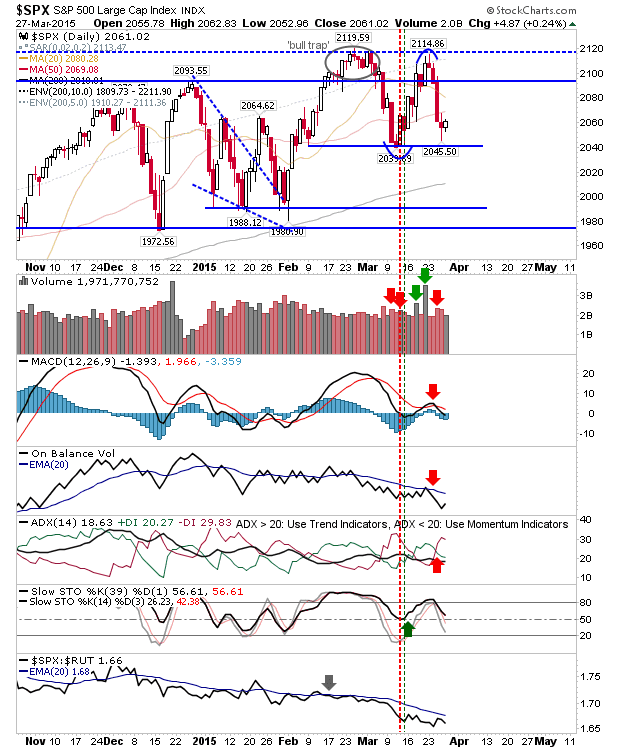

Inside Day Keeps Things Open

Large and Small Caps traded inside yesterday's range, closing lower against yesterday's higher close. While yesterday's buying hasn't been totally eliminated, it will have put a dent in bullish confidence. Watch for follow through selling tomorrow. While the S&P closed above the 20-day and 50-day MA yesterday, today it closed below each of these MAs. Technicals only require a stochastic drop below the bullish mid line to turn net bearish. Relative performance against the Russell 2000 also accelerated downwards.