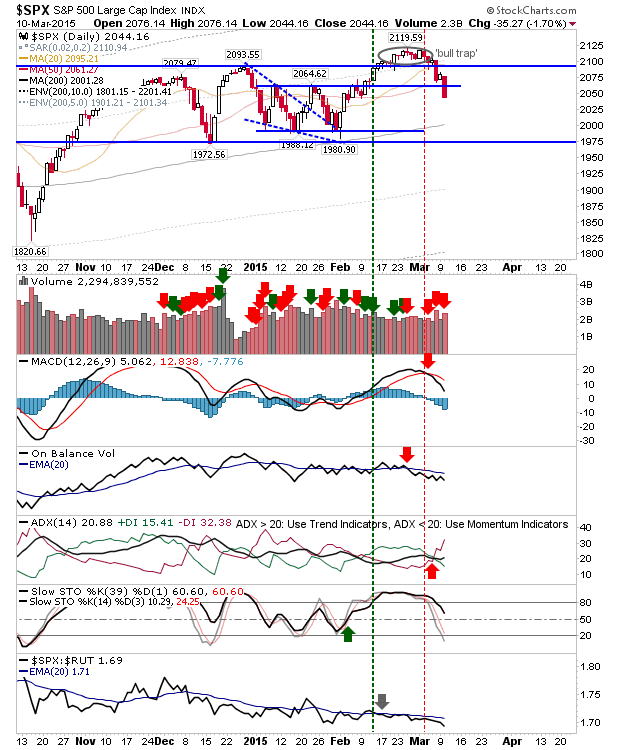

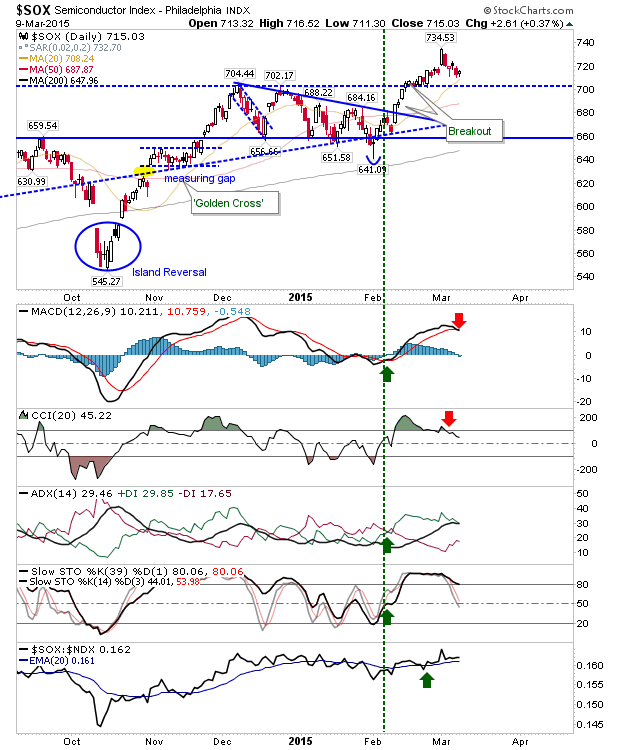

Bull Trap in Russell 2000

What was on offer for bulls yesterday, was delivered today with the 'bear trap' in the Russell 2000. The bounce also occurred off the 50-day MA; an additional confirmation for a swing low. This is good news for bulls looking for a continuation of the broader rally, as it marks cyclical strength.