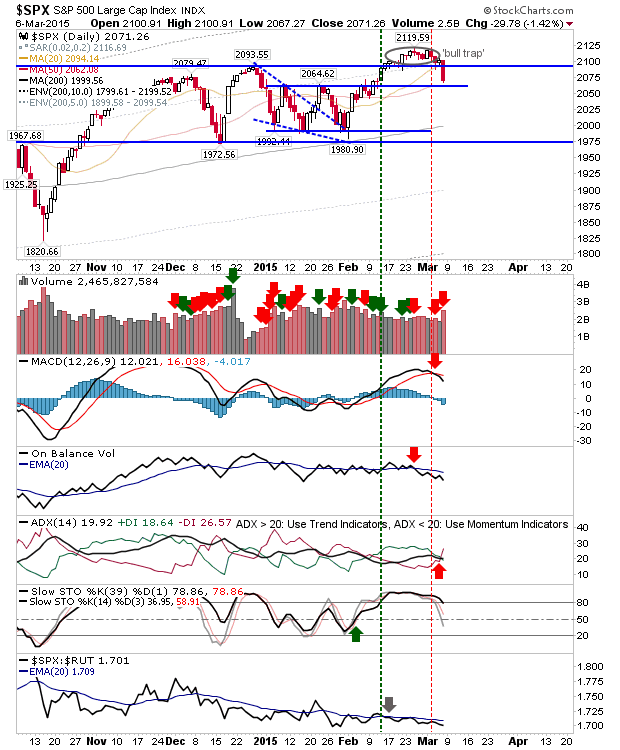

Friday was the first real move bears have successfully pulled off in recent weeks, at least for the S&P and Dow. In the case of the S&P, there was a decisive undercut of 2093 and 20-day MA, with the index finishing just 9 points above its 50-day MA. As the latter moving averages offered little in the way of support in January or February, the likelihood it that we will see another challenge on the 200-day MA. Volume climbed to register a confirmed distribution day, and came with a technical bearish cross between -DI and +DI. Any rally back to 2093 will likely get shorted on Monday.