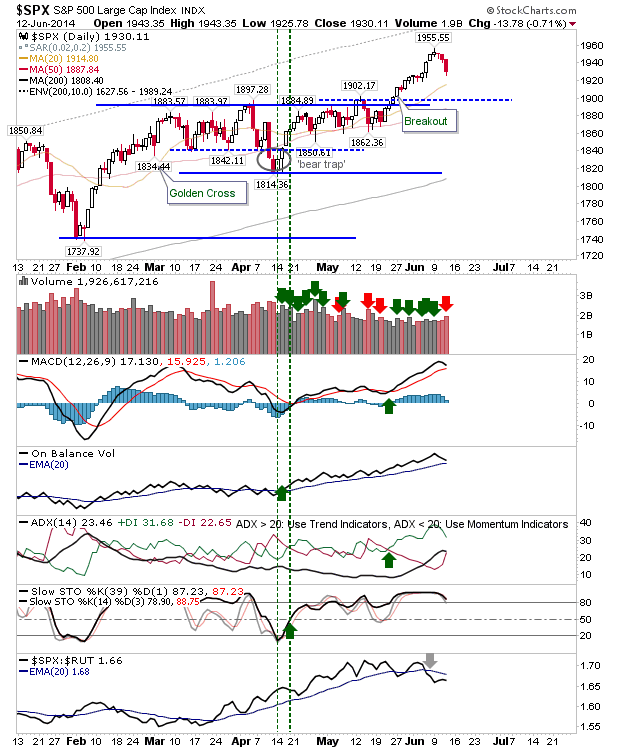

Daily Market Commentary: Watch for Nasdaq Breakout

Lots of buying volume on Friday, although only small gains to match. The Nasdaq is best poised to advance on Monday given it lies just shy of resistance. The narrow range day also offers itself as a swing trade opportunity (with a stop on the flip side). Trend direction suggests this will push higher, becoming a nail in the coffin to what had looked like a (complex) bearish head-and-shoulder reversal.