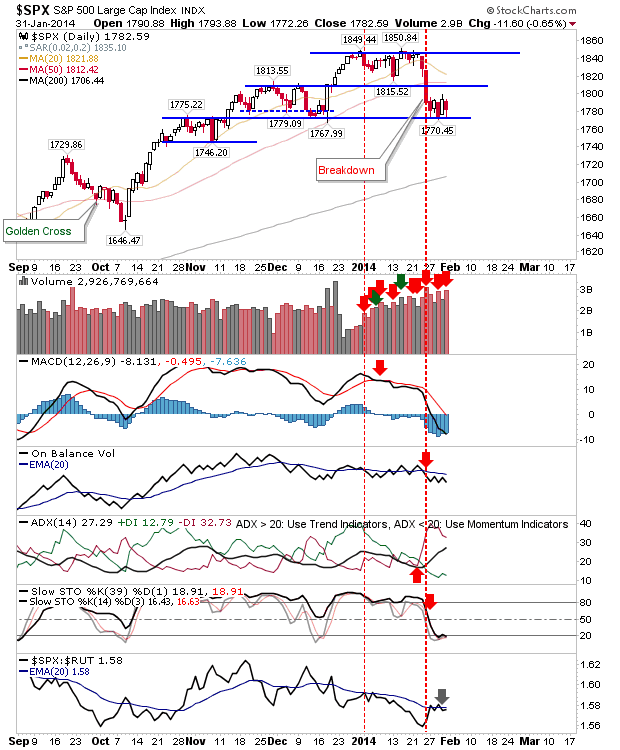

Daily Market Commentary: Bullish Recovery

It was looking a little worrisome for the Russell 2000 after sellers pushed the index below Monday's lows in early action. The index gave back some of the recovered gains by the close, but not enough to reverse what amounted to a bullish hammer. Intermediate and short term stochastics are oversold, but there is no reason to suggest these will contribute to an immediate bounce. The 'bullish hammer' will offer a long side opportunity on a close above the high, risk based on a loss of its lows.