Daily Market Commentary: Volatility and Volume Increases

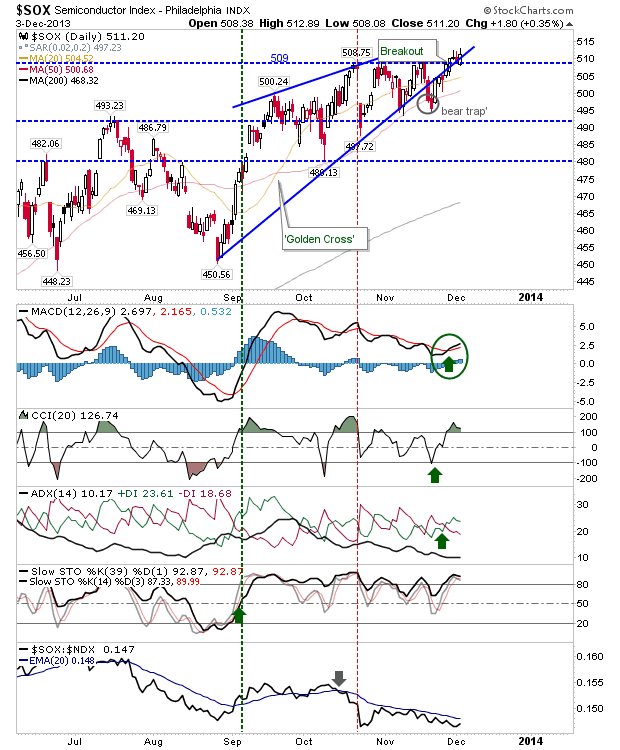

It was to be expected at some point after the holidays, volatility would increase. However, Tech averages had a relatively quiet day, although the semiconductor index had a wobble of its own. For the S&P (and Dow), the increase in volatility left the index flat by the close. The index finished on former upper channel resistance-turned-support, with the 20-day MA also seeing a positive test. However, technicals weakened further with 'sell' triggers in On-Balance-Volume and +DI/-DI, with volume picking up to register a confirmed distribution day. Short term is set up for a bounce, but if this bounce doesn't reverse the technical 'sells', then a larger decline is likely. A close below the 20-day MA today or tomorrow would kill the short term bounce too I think, perhaps bringing in a larger test of the 50-day MA.