Daily Market Commentary: Higher Volume Selling

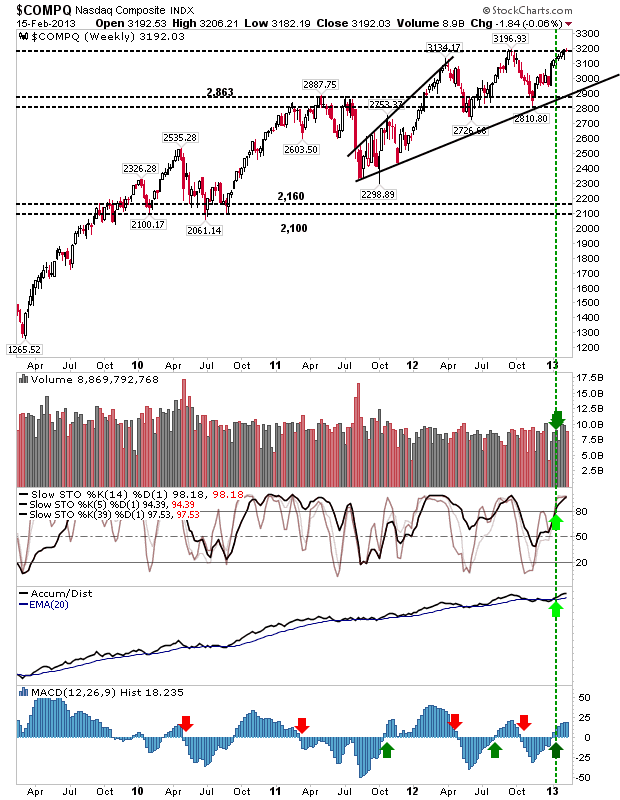

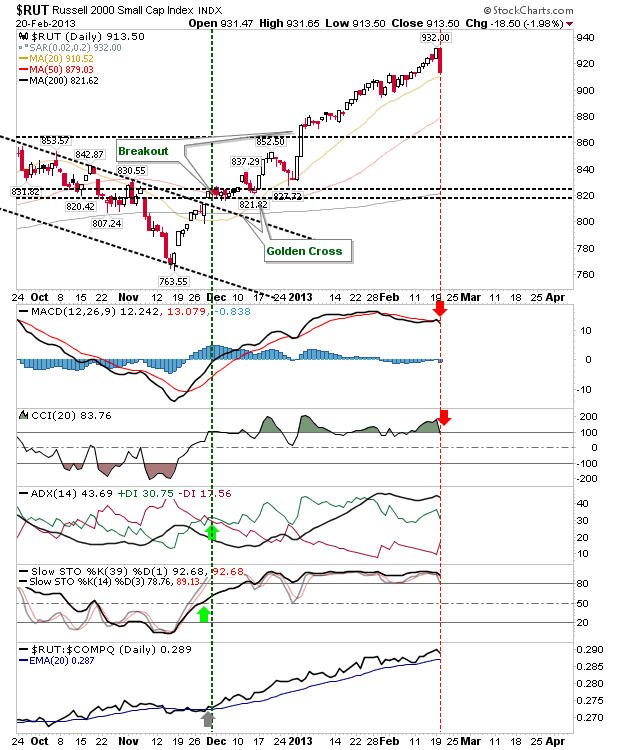

It had to happen sooner, rather than later. Sellers made their presence felt as they pushed markets towards 20-day MAs. A similar sell off occurred in early February and the market made an immediate recovery. I would expect 20-day MAs to be a point of entry for buyers. The question is: will buyers outnumber sellers? The Russell 2000 finished a few points above its 20-day MA. The selling was enough to reverse the whipsaw 'buy' signal in the MACD. The likelihood is for buyers to stall things for a little at the 20-day MA, but the 50-day MA seems a more appropriate place to trade a meaningful bounce.