Weekly Review of StockCharts.com Public Charts

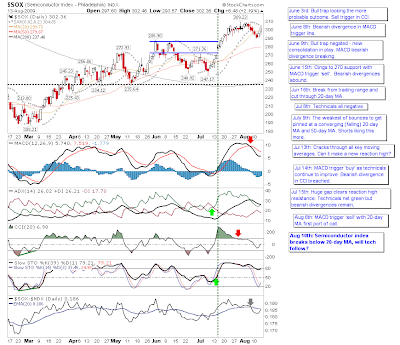

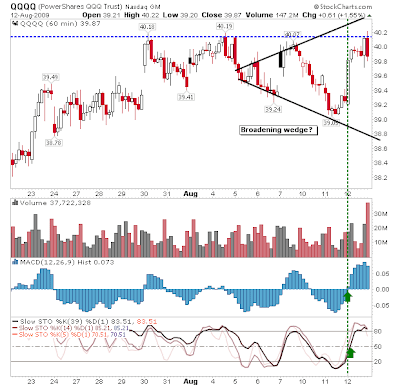

After a lengthy break back is the weekly review of the StockCharters. Futures are taking a beating this morning so the trading range which has been in play for August looks ready to break. Maurice Walker was top-dog of the publishers ranked by hits, but Yong Pan of CobrasMarketView is the lead here. Even given the last time I looked at this summary the short term picture has stayed doggedly neutral. The hindsight July accumulation spike says 875 will be a big defence zone for the S&P Not sure about the SPY 'buy' signal Because the weekly 'sell' signal look dominant Breakout gaps to close; looking more likely to follow the 46% route! Interesting trading plan: Anthony Caldaro of Objectiveeliottwave has me confused on the EWT labelling; not sure how the trend can break into a "abc" as part of the countertrend "ABC" - surely it's a five wave up? Whatever way the count goes it looks like it's down from here. Richard Lehman's sideways