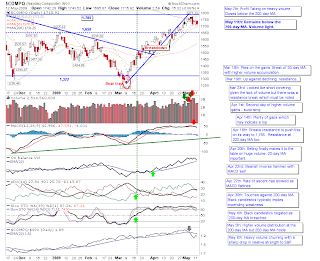

Stock Market Commentary: 20-day MA Support

The Nasdaq lost some, gained some, then lost a little again - but none of it broke below the 20-day MA. The next few days will mark the battle between support of the 20-day MA and resistance of the 200-day MA; these two lines are squeezing together, a violent response is expected. Large caps remain caught between 20-day and 200-day MAs with room to move either way: The Russell 2000 flashed 'sell' signals in supporting technicals: Most worryingly for tech, semiconductors took another substantial hit but the 50-day MA held as support How will it break? Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, stock charts, watchlist, multi-currency portfolio manager and strategy builder website. Forex data available too.