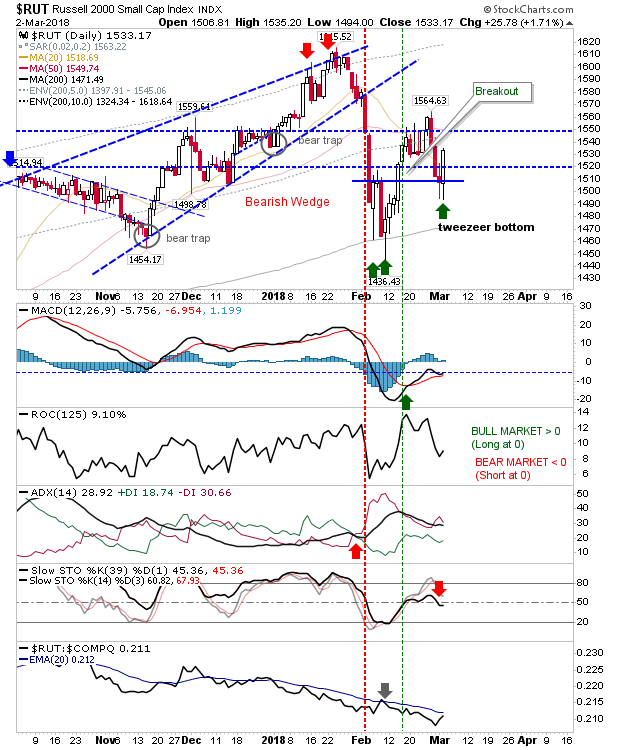

Positive Start to Week

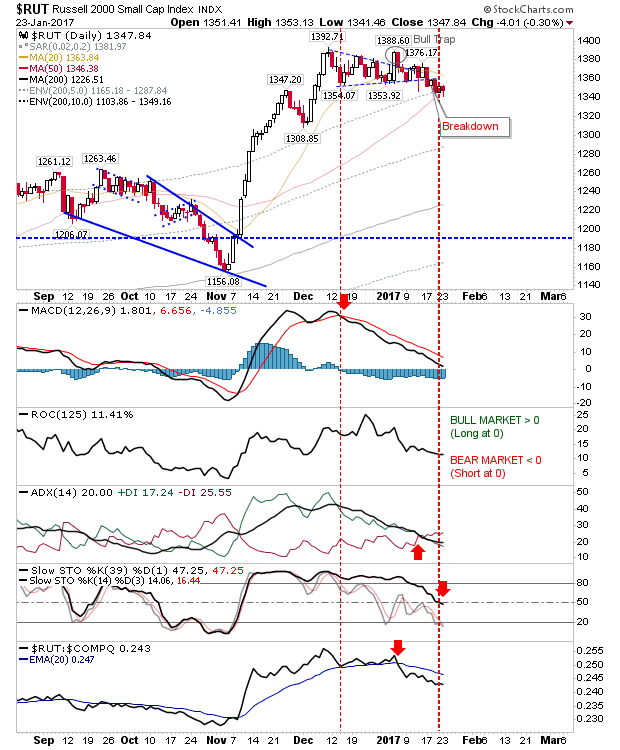

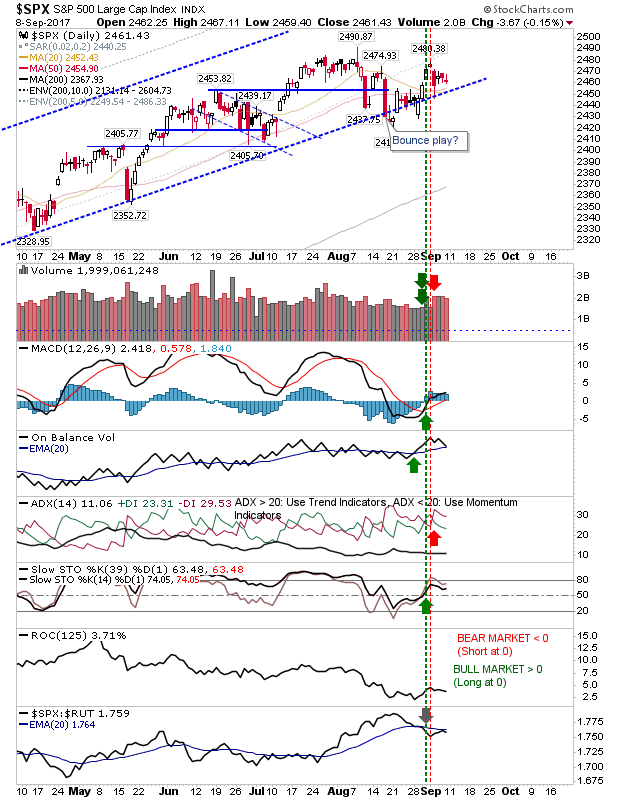

The Russell 2000 led the market out with a 1%+ gain as relative performance continued to gain ground; the next phase of the Small gap rally is well underway. This is good news for bulls looking for gains to continue throughout the summer.