Relief Bounce in Markets

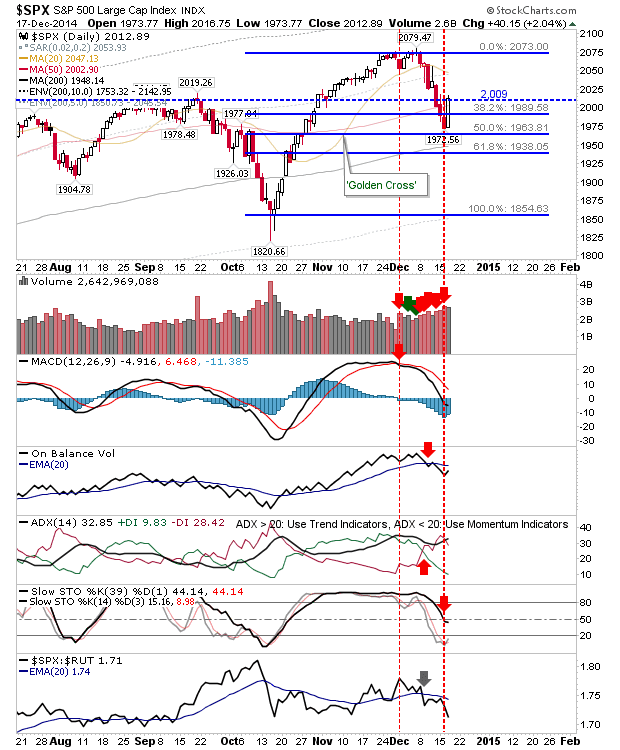

Those who took advantage of markets at Fib levels were rewarded. However, this looked more a 'dead cat' style bounce than a genuine bottom forming low. This can of course change, and one thing I will want to see is narrow action near today's high. Volume was a little light, but with Christmas fast approaching I would expect this trend to continue.

The S&P inched above 2,009, but I would like to see any subsequent weakness hold the 38.2% Fib level at 1,989.

The Nasdaq offered itself more as a support bounce, with a picture perfect play off its 38.2% Fib level. Unlike the S&P, volume did climb in confirmed accumulation. The next upside challenge for the index will be its 20-day MA. Note, yesterday's close marked the turn to net bearish technicals. This is often a marker for a longer term decline.

Small Caps enjoyed a great day, returning 3% and posting what looks like a 'bear trap' in play. Again, I would like to see some consolidation of today's gain, but Small Caps may be the one to deliver the 'Santa Rally' everyone is looking for.

The Semiconductor Index tagged breakout support at 659. A bullish engulfing pattern of Tuesday's doji is also something to consider. It looks to be the index most likely to deliver an immediate follow through gain tomorrow.

For tomorrow. look to the Russell 2000 and Semiconductor Index to deliver upside or consolidate today's gain. Fundamental factors may distort this outlook, but these should level out over the coming days.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P inched above 2,009, but I would like to see any subsequent weakness hold the 38.2% Fib level at 1,989.

The Nasdaq offered itself more as a support bounce, with a picture perfect play off its 38.2% Fib level. Unlike the S&P, volume did climb in confirmed accumulation. The next upside challenge for the index will be its 20-day MA. Note, yesterday's close marked the turn to net bearish technicals. This is often a marker for a longer term decline.

Small Caps enjoyed a great day, returning 3% and posting what looks like a 'bear trap' in play. Again, I would like to see some consolidation of today's gain, but Small Caps may be the one to deliver the 'Santa Rally' everyone is looking for.

The Semiconductor Index tagged breakout support at 659. A bullish engulfing pattern of Tuesday's doji is also something to consider. It looks to be the index most likely to deliver an immediate follow through gain tomorrow.

For tomorrow. look to the Russell 2000 and Semiconductor Index to deliver upside or consolidate today's gain. Fundamental factors may distort this outlook, but these should level out over the coming days.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!