Minor Gains Continue as Semiconductors Shape Handle

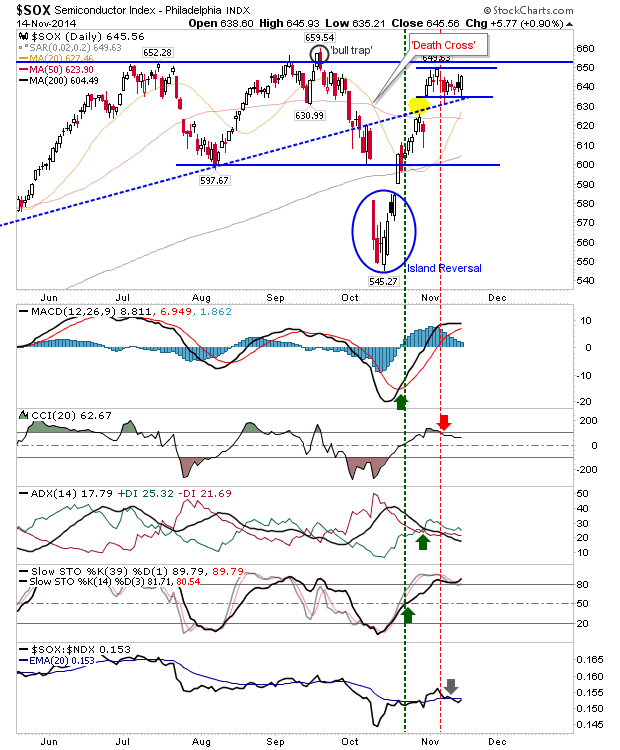

While I'm late with this weekend's update there was very little to add from Thursday. Best of the action remains in the Semiconductors, which is shaping a solid handle in preparation for a possible break higher (ignore the 'Death Cross' between 20-d and 50-d MAs - this is now a 'Golden Cross').

I don't think I have updated the S&P chart since early last week. The same Fib retracement values remain in effect.

Although, I have inched out the Fib retracements for the Nasdaq.

One interesting aspect for the Nasdaq was the tag (breakout?) of channel resistance in the Nasdaq Bullish Percents. Will this tag mark a breakout, and an acceleration of the tiny gains we have seen? Or will it be the start of a move back into Fib levels? Time will tell, but today/tomorrow is decision day for this test.

Other breadth metrics still side with bulls. The Nasdaq Summation Index in particular has offered little evidence for weakening.

If there is a bearish tone, it has been set by the Russell 2000. The 'bull trap' from what had looked to have been a handle breakout is still in effect. Although, if you were to go on real-body support/resistance only, then there is no 'bull trap' and Friday's action was a test of former flag resistance, turned support. One to watch.

For today, longs should keep a watchful eye on the Semiconductors, and shorts should look for expanding weakness in the Russell 2000.

---

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

I don't think I have updated the S&P chart since early last week. The same Fib retracement values remain in effect.

Although, I have inched out the Fib retracements for the Nasdaq.

One interesting aspect for the Nasdaq was the tag (breakout?) of channel resistance in the Nasdaq Bullish Percents. Will this tag mark a breakout, and an acceleration of the tiny gains we have seen? Or will it be the start of a move back into Fib levels? Time will tell, but today/tomorrow is decision day for this test.

Other breadth metrics still side with bulls. The Nasdaq Summation Index in particular has offered little evidence for weakening.

If there is a bearish tone, it has been set by the Russell 2000. The 'bull trap' from what had looked to have been a handle breakout is still in effect. Although, if you were to go on real-body support/resistance only, then there is no 'bull trap' and Friday's action was a test of former flag resistance, turned support. One to watch.

For today, longs should keep a watchful eye on the Semiconductors, and shorts should look for expanding weakness in the Russell 2000.

---

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!