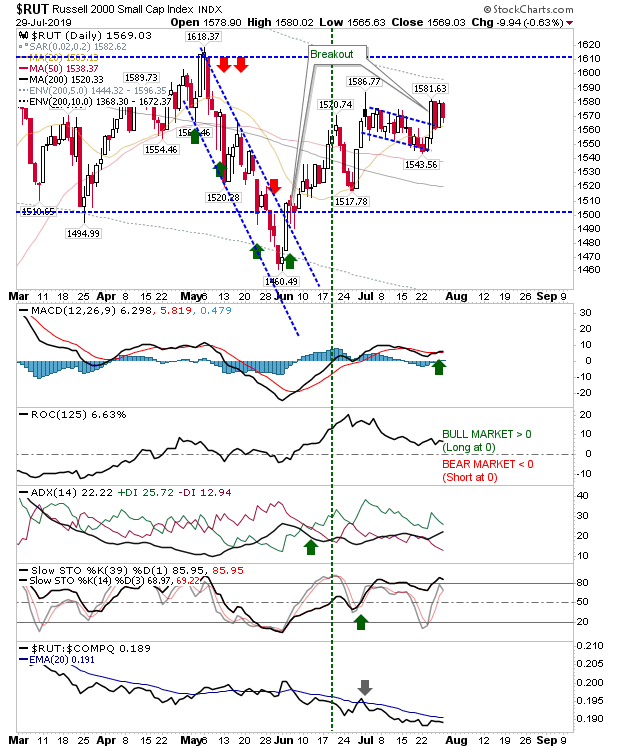

Markets Whacked

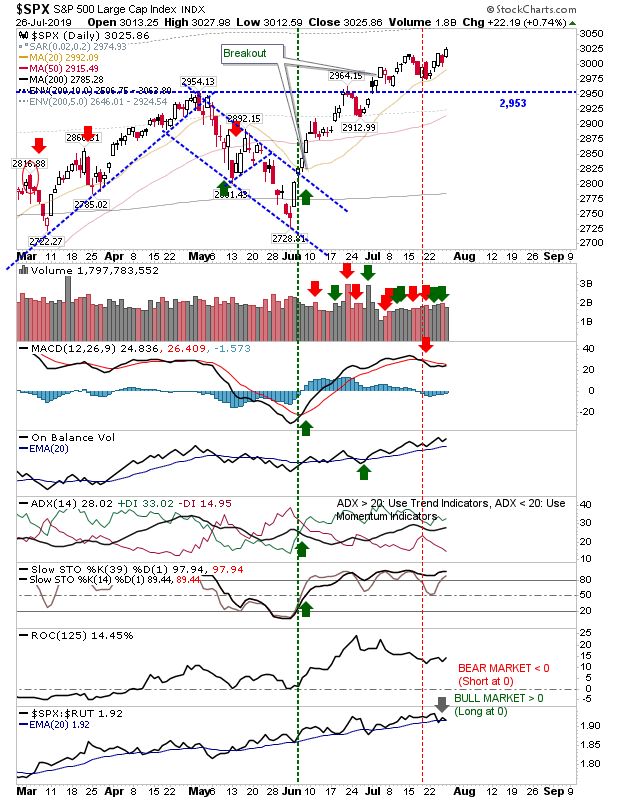

Big losses swept the market as the Chinese trade war was blamed for today's decline, but Trump chaos has been influencing the market for a long time and the failure of the June breakouts is a more likely cause of the continued selloff. For the S&P, the next move is heading down to retest the June swing low of 2,728. Technicals are net bearish and losses were less than hit the Russell 2000 so it has actually managed a relative gain. Before it gets there, the 200-day MA is first up.