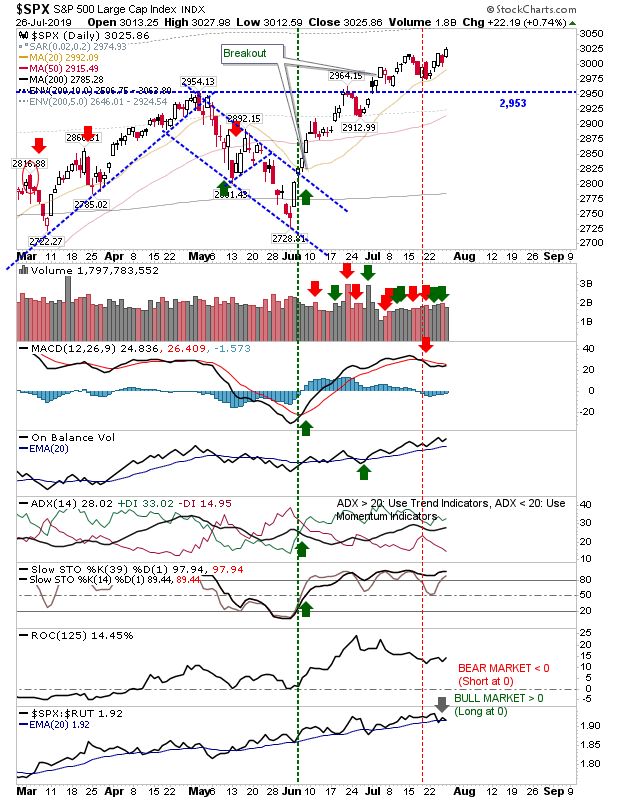

The Back-and-Forth Between Bulls and Bears Continues

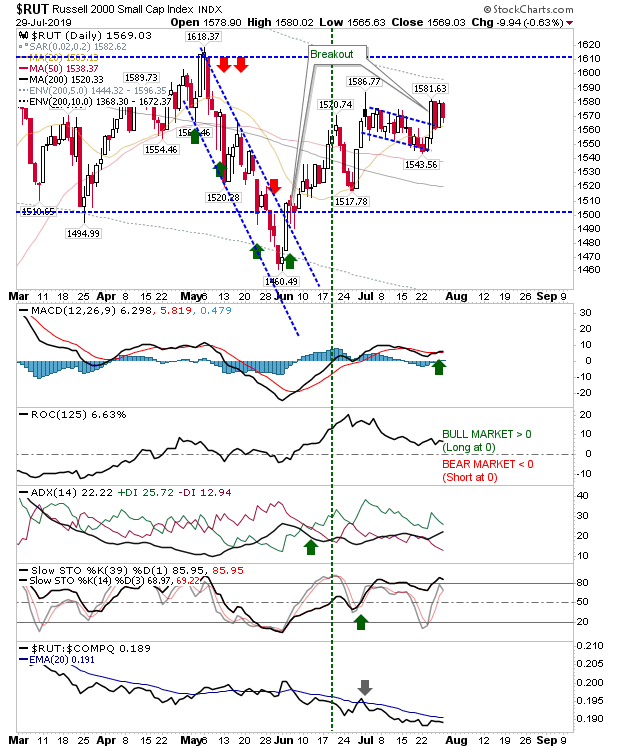

Sellers returned as the sequence of buy-sell-buy-sell continued. Action for the last four days continued to coil with the Russell 2000 showing this best with a series of inside days. I would like to see this pattern break upwards and pressure 1,610s as it would maintain bullish confidence for Large Caps and Tech indices too. The Russell 2000 still suffers from relative underperformance despite its recent improvement, but all other technicals are bullish, including a MACD trigger 'buy'.