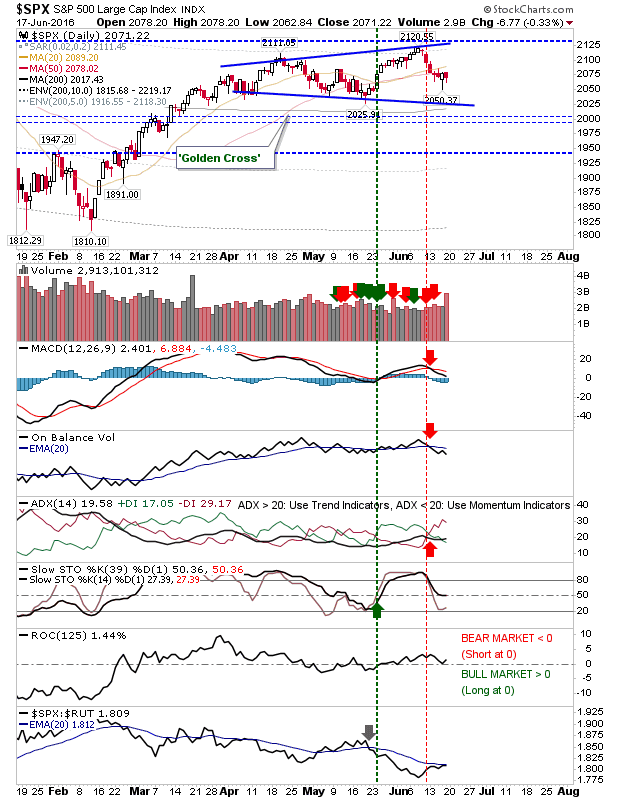

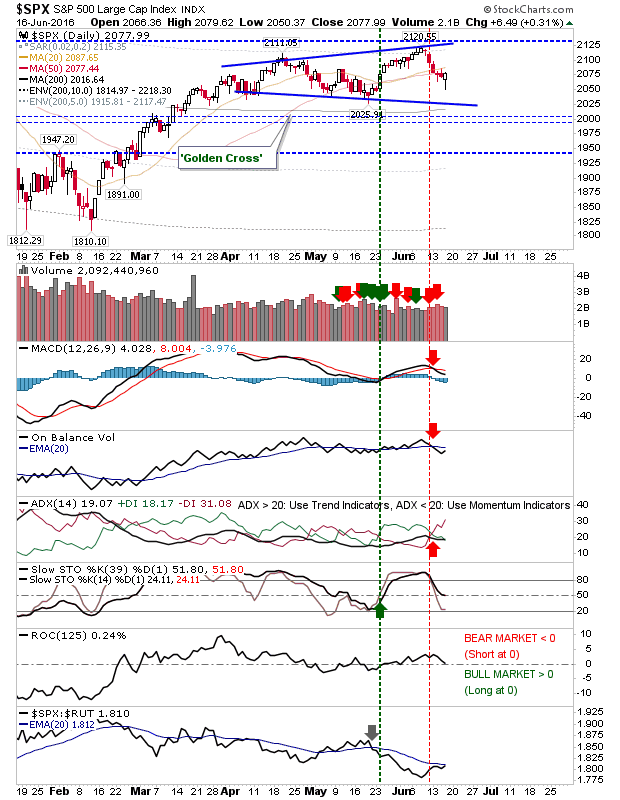

A positive day on suggestions Brexit may not happen invited bulls back to market, Action to this point had the look of a pullback swing low (at least as from Thursday's action), so it was easy for buyers once it was clear there was a strong premarket. What was disappointing was the late sell off, which probably did more damage than Friday's selling, but this can be rectified with a Tuesday close inside the upper part of today's intraday range. For the S&P, today's action meant an inverse hammer crossover of the 20-day and 50-day MAs. It's interesting to see stochastics [39,1] court the bullish midline in what would traditionally be a buying opportunity - so on the chance bulls are able to open the S&P above today's close then today's damage on the intermediate time frame (up to 3 weeks) may be slight.