Honors Shared

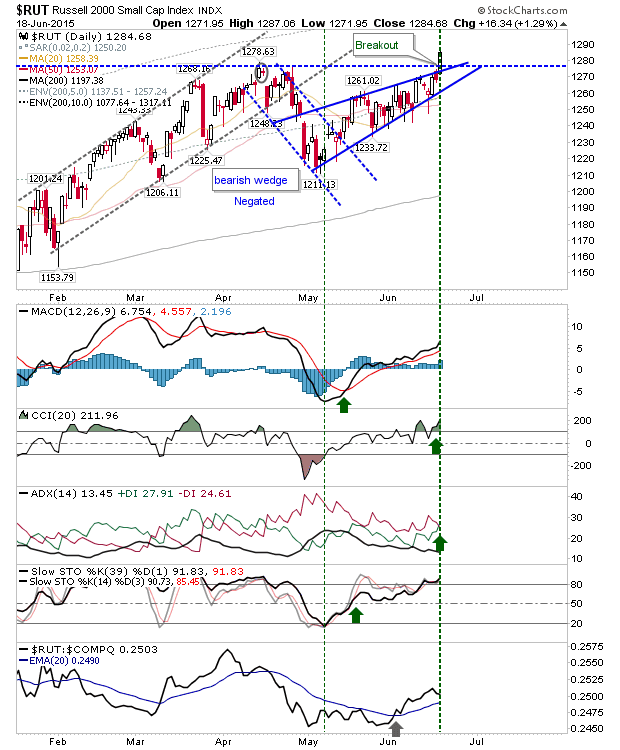

Today was a big non-event. There was probably hope for more from the Greece story, but a stay of execution keeps things ticking over for another couple of days. The S&P was kept pegged below 2,135, but maintains its trendline breakout.