The Year Starts With Selling

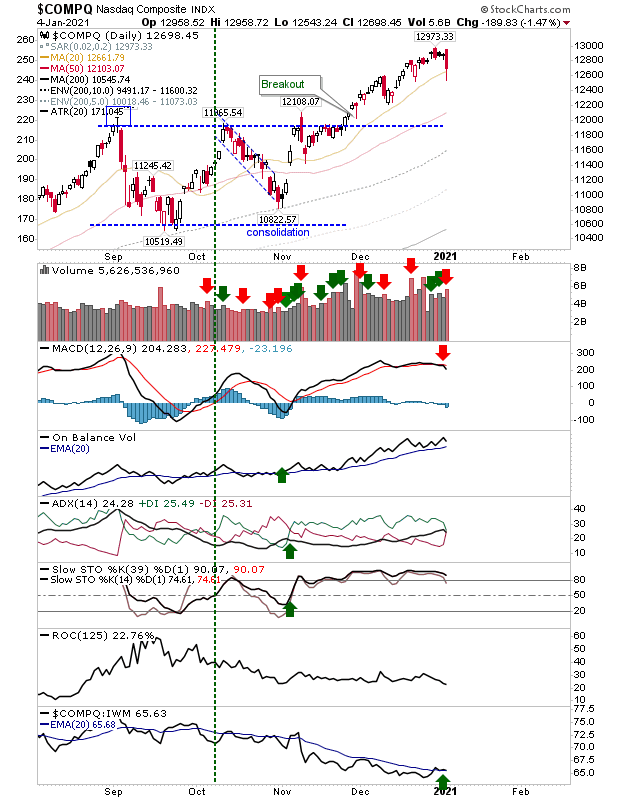

The first day of the New Year starts with selling on heavier volume distribution. Today may be the start of something, but one day's selling does not make a crash.

For the Nasdaq, we have the MACD trigger 'sell' but still a bullish cross in relative performance to Small Caps. The selling was looking bad but buyers were able to step in at the 20-day MA.

The S&P similarly sold off on heavy volume with a fresh 'sell' trigger in On-Balance-Volume to follow that of the MACD.

While the Russell 2000 was the first index to turn and did experience distribution today, it was able to successfully defend its 20-day MAs.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.