Prices drift modestly higher on light volume

There was a relatively wide intraday range day for markets, but by the close of business most indices were back where they started.

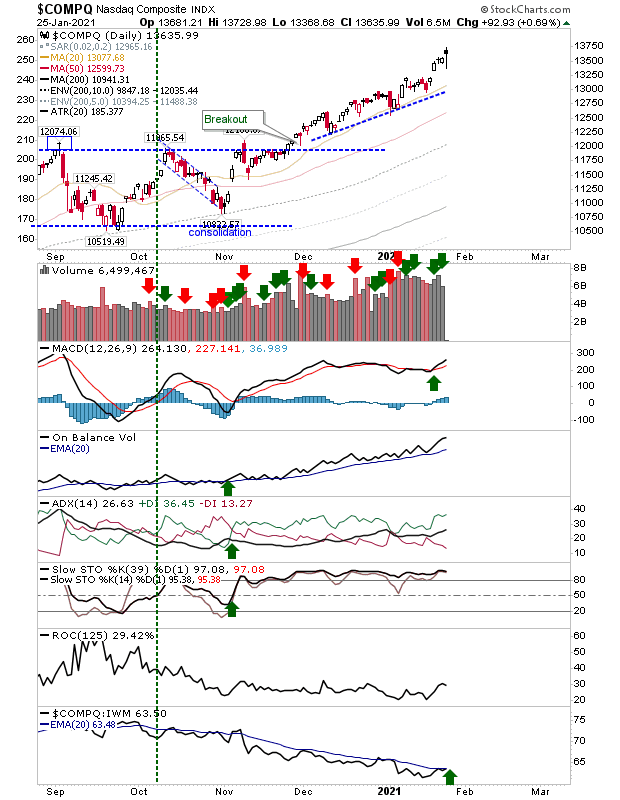

The biggest gain came from the Nasdaq, but it closed with a doji at a swing high. This is typically a neutral candlestick, but can also mark a reversal. The Nasdaq is starting to run a relative performance advantage over the Russell 2000.

The S&P came close to tagging the 20-day MA in the process of day's intraday swing. Technicals are all net bullish with the exception of the relative performance to the Russell 2000 which has remained in a long term decline since October.The Dow Jones Industrial Average tagged the rising trendline (and 20-day MA) on a doji in a successful test. However, unlike other indices - the S&P included - the MACD, On-Balance-Volume and ADX are net bearish.

We will be watching the Dow Jones Industrials average for leads to see if weakness in this index spreads to other indices.

---

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.