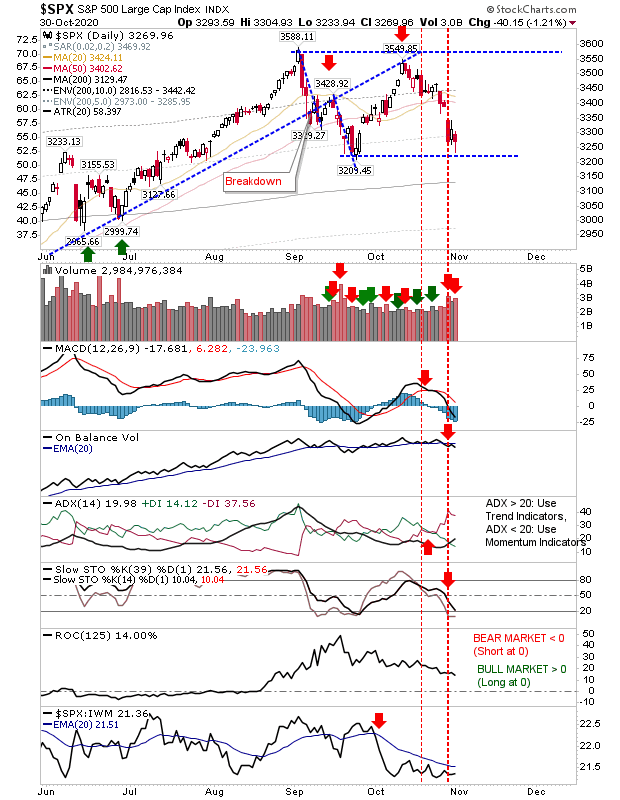

S&P Tags Consolidation Support - But Will It Hold?

With the election fast approaching we see the tension express itself in the market with an increase in volatility. The direction of the popular vote may be known, but its hard to see the result on Wednesday as been considered final - at least as long as Trump doesn't win. The vote will tighten on Tuesday and only a blowout will prevent the legal wranglings to follow. None of this makes for comfortable reading for the market, and this uncertainty is coming to a head.

The September bounce has faded, but the S&P is able to find support support at the September swing low, suggesting buyers are willing to step in to support the market. Friday's selling marked itself as confirmed distribution, so while there are buyers it may yet be sellers who take this beyond support and maybe into a test of the 200-day MA. Technicals are all net negative, including what looks to be a trend reversal in on-balance-volume after a summer of accumulation.

Tech averages have performed stronger, but it's hard not to see a similar pattern play out for the Nasdaq as for the S&P. It may be after the election when the September low test happens. But if there is an early response on Monday from the S&P it may yet not come to that. Friday's selling also marked itself as confirmed distribution.You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.