And the wait continues...

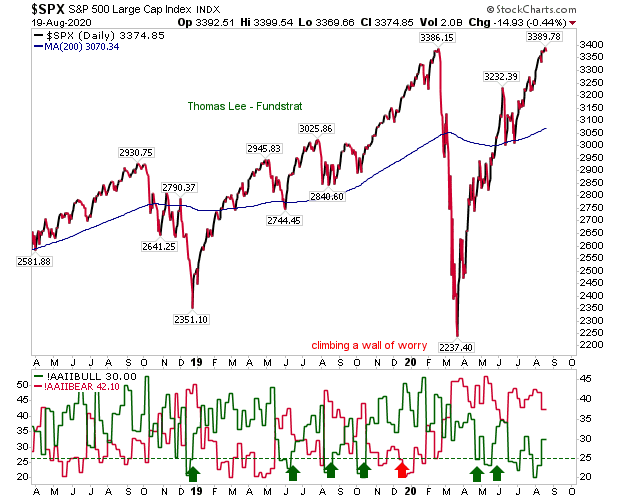

A day of small losses but no real damage to the rallies. With the S&P joining the Nasdaq in erasing Covid losses, everyone is waiting for sellers to sweep in and kill this rally but they might be for a surprise. The American Association of Individual Investors sentiment is firmly in the bear column, which means bulls may be the one to benefit as it typically plays as a contrarian indicator.

With markets back at pre-Covid highs there is no longer a discount for a pandemic which continues to rage and looks like it will get worse before it gets better. If you are happy to buy in this environment, fire away. Contrarians will see the AAII bearish sentiment as a reason to keep buying but with market breadth metrics on new 'sell' signals - or getting there - the reasons to be buying are slowly been reduced. For example, the 'sell' signal in the Nasdaq Summation Index is partnered with a bearish divergence to the parent index.

So while indices continue to make small gains or losses on a daily basis, the larger picture points to developing new 'sell' signals which may be enough to take down the various rallies across indices.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.