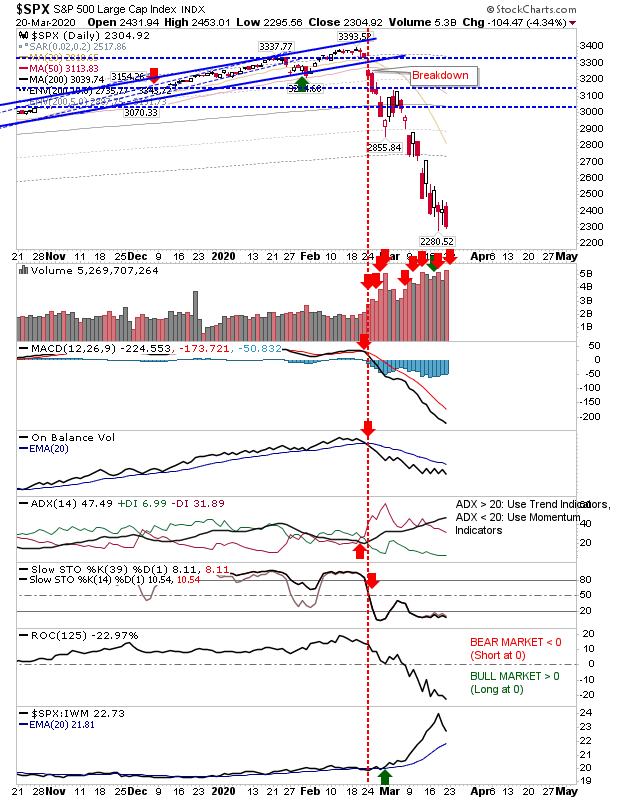

Wednesday had offered the opportunity for the start of a swing low following a 'bullish' hammer in the S&P, but there were more indecisive candlesticks in the Nasdaq and Russell 2000, and with Friday's selling coming on the back of higher volume - although this coincided with a Triple witch for options expiration - undermined any possible demand mid-week action could have hinted at.

Markets are again in a situation seeking a low, and with key indices finishing near the week's lows (likely awaiting news over the weekend), the chance for yet another gap down tomorrow looks high. What will be important will be the selling volume - we want to see some exhaustion (light volume) on down days, followed by higher volume buying on days markets are able to close higher.

The S&P looks like it will gap down tomorrow; failed 'bullish hammer's have a nasty habit of trying to seek new lows. The only thing 'to like' here is the relative underperformance against the Russell 2000; if traders are moving back to more speculative stocks it might raise the opportunity for a more sustained low.

Speaking of the Russell 2000 (or at least, the ETF - $IWM), Friday's selling was relatively muted. It has managed to establish a nascent low, although Friday's 'bearish cloud cover' pattern can't be allowed to develop. Friday's volume was some of the highest it has experienced since the crisis began - which is nearly five times the volume of pre-crisis.

The Nasdaq finished with a engulfing pattern - although this pattern is only considered bearish as a reversal pattern in an overbought condition, and we are long way from that! However, the Nasdaq is outperforming the S&P and the mid-week low is still intact.

While breadth metrics are also weak, Nasdaq Bullish Percents have been ticking higher, despite the loss in the parent index. It's one of the few positives in a sea of negatives.

For tomorrow, the S&P has set up for a gap down, but the Russell 2000 still has an opportunity to continue its swing low. Breadth metrics are heavily oversold, but they have been in this situation for a long time now...

You've now read my opinion, next read

Douglas' blog, and then

J.C. Parets.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.