S&P Bounds Along Support, Nasdaq Bounds Along Resistance

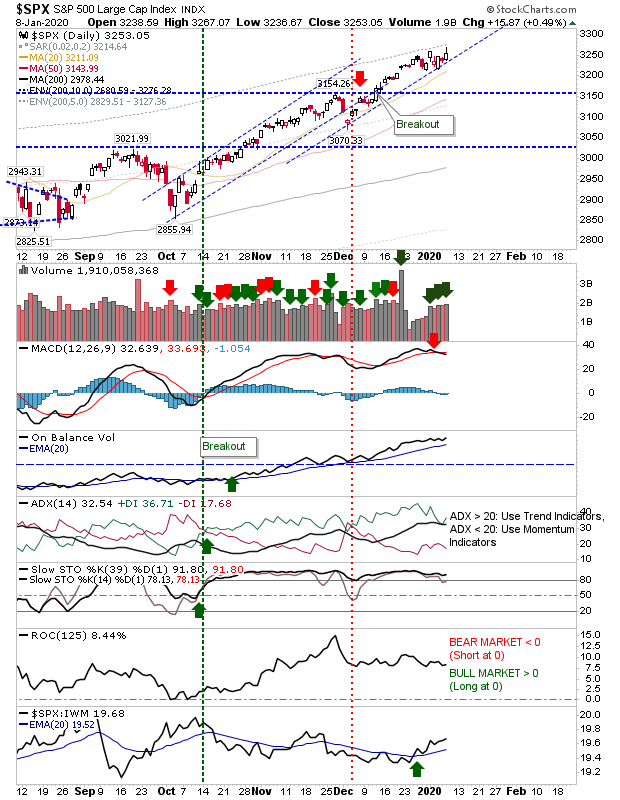

Overall, it was a good day for indices despite Middle East tensions. The margins are small, but the S&P is moving nicely along rising trendline support, while the Nasdaq is running along upper resistance.

The S&P is enjoying a relative performance advantage although the MACD has drifted into a 'sell' trigger. Other technicals are good and price action is strong. Volume inched higher as accumulation.

The Nasdaq is doing a little better than S&P in that it's rally is actually running up against resistance as part of a narrow channel. Technicals are all good with no conflicts although the MACD is trending towards a 'sell' trigger.

The Russell 2000 had broken from the rising channel as money rotated out of growth stocks into technology sector stocks. The MACD trigger 'sell' confirmed a slowing of the rising trend - but the trend is continuing.

The Dow Jones Index is also trending higher on the back of a sustained relative underperformance against Tech Indices. Again, other technicals are positive and unlike the S&P is not riding along support.

The Semiconductor Index is one of the strongest indices in relative performance having well surpassed the August/September swing highs; this is setting the early tone for 2020.

No reason for change in the outlook as all lead indices chug higher.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The S&P is enjoying a relative performance advantage although the MACD has drifted into a 'sell' trigger. Other technicals are good and price action is strong. Volume inched higher as accumulation.

The Nasdaq is doing a little better than S&P in that it's rally is actually running up against resistance as part of a narrow channel. Technicals are all good with no conflicts although the MACD is trending towards a 'sell' trigger.

The Russell 2000 had broken from the rising channel as money rotated out of growth stocks into technology sector stocks. The MACD trigger 'sell' confirmed a slowing of the rising trend - but the trend is continuing.

The Dow Jones Index is also trending higher on the back of a sustained relative underperformance against Tech Indices. Again, other technicals are positive and unlike the S&P is not riding along support.

The Semiconductor Index is one of the strongest indices in relative performance having well surpassed the August/September swing highs; this is setting the early tone for 2020.

No reason for change in the outlook as all lead indices chug higher.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.