Friday's Losses Reversed But Breakouts Remain On Hold

It was a good start to the week with Friday's losses reversed in their entirety, although trading volume was down on Friday's selling.

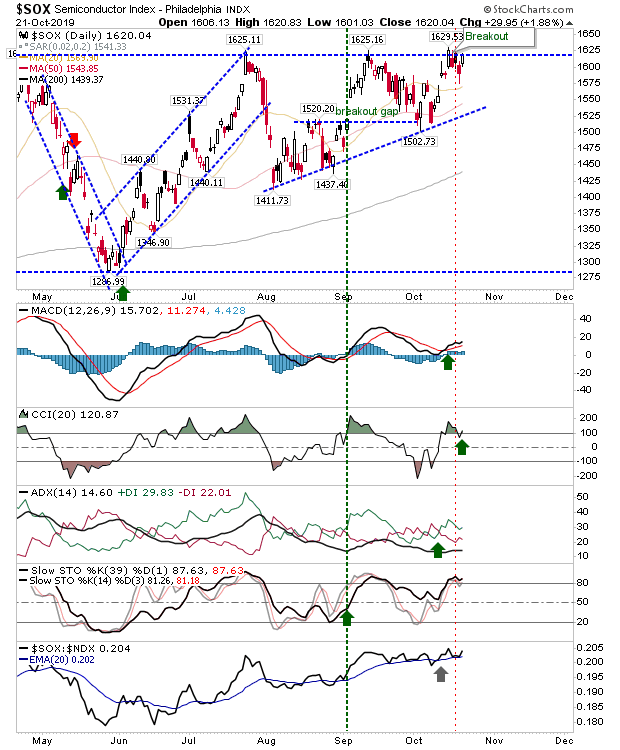

The Semiconductor Index is closest to breaking out (for a third time) but technicals are all net bullish. It just needs to kick on after the recent back-and-forth.

For the S&P, most of the work was done prior to market open and the index is less than 20 points from a breakout. On-Balance-Volume returned to a 'buy' trigger.

The Nasdaq is likewise set up to mark a mini-break of 8,200 before going on to challenge 8,300. It's just clinging on to its 'sell' trigger in On-Balance-Volume but this is unlikely to stay this way for long.

The Russell 2000 made the best gain on the day, but it also has the most ground to make up before it can be considered to be challenging a breakout as for other indices.

So, for tomorrow, focus is on whether the Semiconductor Index can finally pull away from breakout resistance. Third time lucky for the index.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The Semiconductor Index is closest to breaking out (for a third time) but technicals are all net bullish. It just needs to kick on after the recent back-and-forth.

For the S&P, most of the work was done prior to market open and the index is less than 20 points from a breakout. On-Balance-Volume returned to a 'buy' trigger.

The Nasdaq is likewise set up to mark a mini-break of 8,200 before going on to challenge 8,300. It's just clinging on to its 'sell' trigger in On-Balance-Volume but this is unlikely to stay this way for long.

The Russell 2000 made the best gain on the day, but it also has the most ground to make up before it can be considered to be challenging a breakout as for other indices.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.