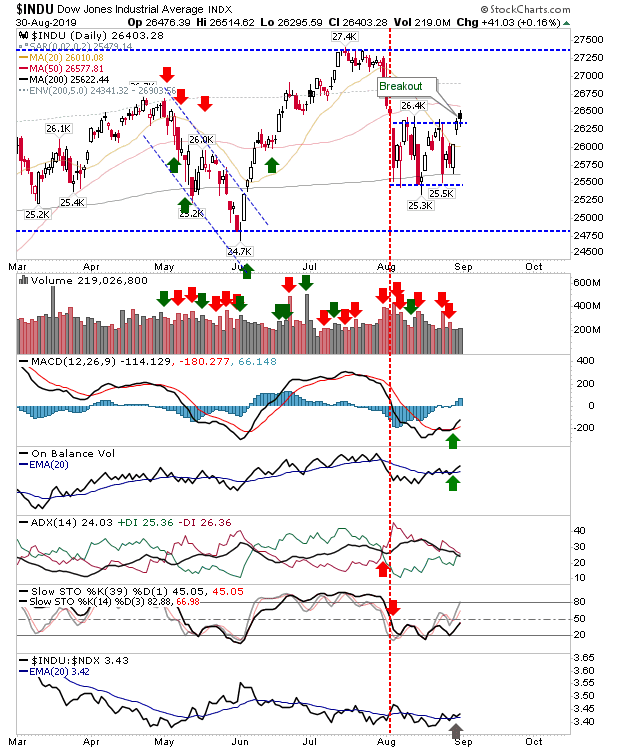

There wasn't a whole lot to report from Friday with all indices inside dominant consolidation indices. Best of the action belonged to the Dow Industrial Average as it broke out of its mini-consolidation, nested inside its 2-year consolidation. Again, the larger consolidation is dominant, so the significance of Friday's action is reduced. There are existing 'buy' signals for the MACD trigger and On-Balance-Volume but longer term stochastics are still in bearish territory

The Russell 2000 is an index under pressure. Friday's action was low key, but it marked a third-tag reversal off widened resistance. With the index so close to major, consolidation support, it's a worrying time for the index. Monday or Tuesday needs to be a big rally day to restore some form of confidence. On some good news, there was a fresh MACD trigger 'buy' - although it occurred well below the bullish zero (mid-) line.

Not a whole lot to report from the Nasdaq as it finished with a bearish candlestick, but this occurred outside of the consolidation - and is perhaps reason enough to redraw resistance. Volume was lighter, and there was a mixed technical picture with a MACD trigger 'buy' offset by the sell in On-Balance-Volume.

The S&P didn't quite enjoy the same breakout as in the Dow Industrial Average, and is in a similar picture as the Nasdaq. The 'black' candlestick is another bearish marker against the stock, but is offset by the 'buy' triggers in the MACD and On-Balance-Volume.

On more positive news, the Nasdaq Summation Index (a relatively smooth breadth metric) offered what looks to be a new 'buy' signal. There was a bullish cross in the 3- and 5-day EMA, alongside new 'buy' signals in the MACD and CCI. I would like to see the ADX stronger, but this is something worth watching, even if the parent Nasdaq is looking a little directionless.

For Monday, we will want to see the Nasdaq push on out of its consolidation, following the action of the Dow on Friday. This should help the S&P and Russell 2000. The only problem will be Trump tweets, and whether the market decides to listen to the fool.

You've now read my opinion, next read

Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.