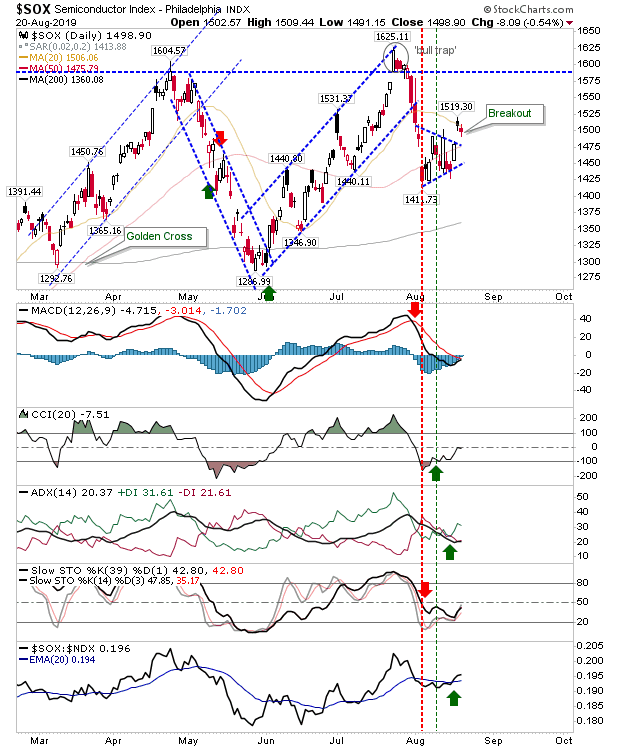

Semiconductors Break Upside From Pennant Consolidation

In attempt to break the deadlock of the recent consolidations, the Semiconductor Index gapped above its pennant. Today's losses didn't close the gap, keeping the bullish move intact - for now. New support is 1,412. The next challenge is 1,605. The relative performance advantage of the Semiconductor against the Nasdaq 100 ticked higher with further gains in the CCI and +DI/-DI

The Russell 2000 bounce off 1,465 support is also playing as a downward channel/flag consolidation. June delivered a breakout from the channel formed from May highs, so a chance for a comparable breakout is still possible here within the context of the consolidation.

The S&P is shaping a potential pennant below 20-day and 50-day MAs. On-Balance-Volume is holding above its 20-day MA but other technicals remain bearish.

The Nasdaq is also mapping a broad consolidation, but like the S&P is doing so from below its 20-day and 50-day MAs. Technicals are net bearish but the index is outperforming the S&P.

Going forward, we will need to see the pennant breakout in the Semiconductor Index gain ground and bring the Nasdaq - and by association, the S&P and Russell 2000 - with it.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The Russell 2000 bounce off 1,465 support is also playing as a downward channel/flag consolidation. June delivered a breakout from the channel formed from May highs, so a chance for a comparable breakout is still possible here within the context of the consolidation.

The S&P is shaping a potential pennant below 20-day and 50-day MAs. On-Balance-Volume is holding above its 20-day MA but other technicals remain bearish.

The Nasdaq is also mapping a broad consolidation, but like the S&P is doing so from below its 20-day and 50-day MAs. Technicals are net bearish but the index is outperforming the S&P.

Going forward, we will need to see the pennant breakout in the Semiconductor Index gain ground and bring the Nasdaq - and by association, the S&P and Russell 2000 - with it.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.