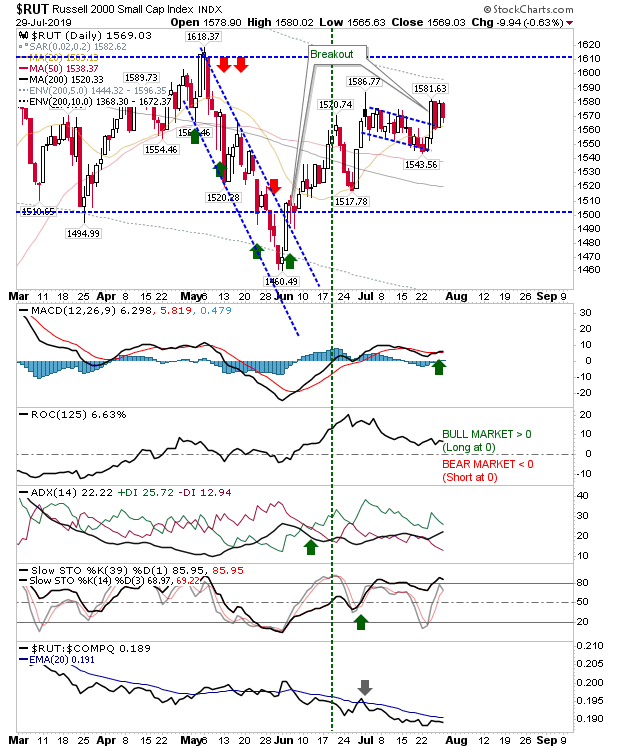

Sellers returned as the sequence of buy-sell-buy-sell continued. Action for the last four days continued to coil with the Russell 2000 showing this best with a series of inside days. I would like to see this pattern break upwards and pressure 1,610s as it would maintain bullish confidence for Large Caps and Tech indices too.

The Russell 2000 still suffers from relative underperformance despite its recent improvement, but all other technicals are bullish, including a MACD trigger 'buy'.

The S&P finished with light volume selling as it's inside day is probably as small as it can get; look for a larger reactionary move before the week is out; day traders will probably swing trade the break off today's high/lows.

The Nasdaq spiked a little more into it's lows and unlike the S&P it has a MACD trigger 'sell' to deal with. However, there is plenty of room down to breakout support for it to tolerate a few additional days of selling from here.

Despite this, the Semiconductor Index continued to play well at breakout support; a small 'bullish' hammer at 1,600 - although with stochastics overbought, the bullish significance of this typical reversal candlestick is reduced.

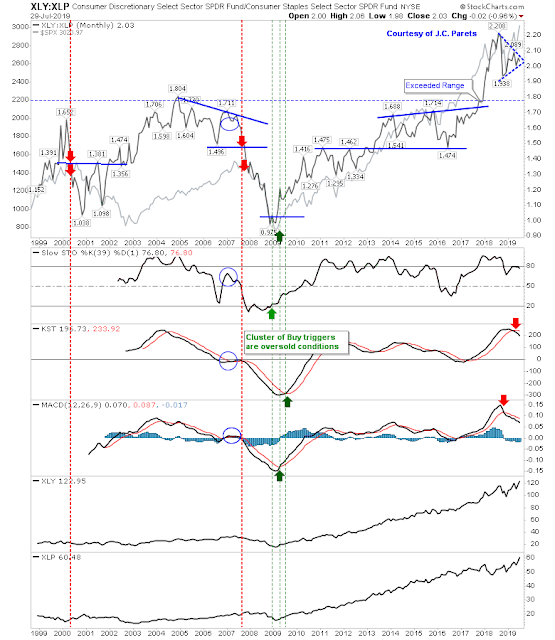

One of the breadth metrics I'm watching is J.C. Parets Consumer discretionary to staples ratio. The ratio is siding in favour of bears (supported by the 'sell' triggers in KST and MACD) but the developing pennant consolidation hasn't broken yet.

So for tomorrow, I'll be looking for the mini-consolidations to break higher while longer term breadth metrics may be pointing towards another sideways consolidation. However, with the breakout still so recent I don't see consolidations emerging until at least this rally has had a few months to develop. A worst case scenario is a 'bull trap' but even this will take a few days to emerge.

You've now read my opinion, next read

Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.