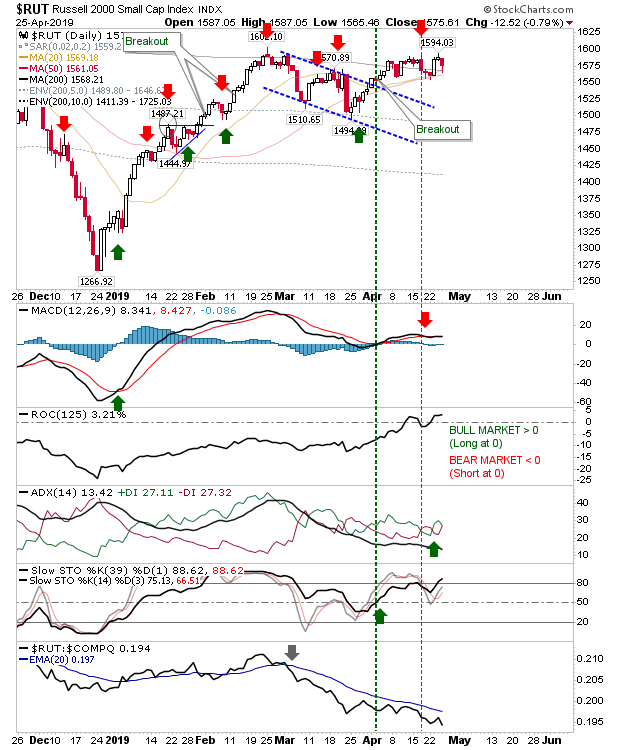

Small Caps Fall Back To Converged Moving Averages

There wasn't a whole lot to today's action despite the damage done to my monitored Shutterstock ($SSTK) following disappointed earnings. The Small Caps index fell back into converged 20-day, 50-day and 200-day MA.

The S&P lost a little ground on lighter volume but the minor gains of past few weeks have been using the 20-day MA to work support. Look for repeat as occurred in the latter part of March.

While the S&P could use the 20-day MA to mount a demand bounce, the Nasdaq has a little more room to maneuver before an equivalent test can be mounted. Technicals are all net bullish.

While the Nasdaq is holding ground, the Semiconductor Index lost nearly 2%; it remains well above its moving averages. Despite this, a test of the 20-day MA would be sufficient to be very damaging to supporting Tech indices, although it would help consolidated the advance off 1,293. Look for some solo downside to work as a test of the 20-day MA.

For tomorrow, attention can remain on the Semiconductor Index and supported Nasdaq and Nasdaq 100. Expectations are for more downside but there is plenty of room for a surprise.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The S&P lost a little ground on lighter volume but the minor gains of past few weeks have been using the 20-day MA to work support. Look for repeat as occurred in the latter part of March.

While the S&P could use the 20-day MA to mount a demand bounce, the Nasdaq has a little more room to maneuver before an equivalent test can be mounted. Technicals are all net bullish.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.