Quiet Day

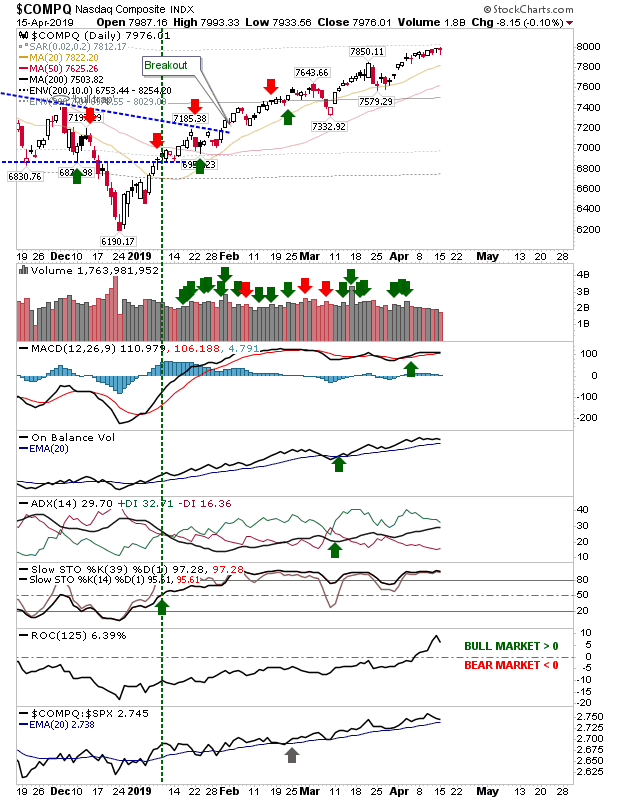

Not much to say about today - good or bad. The Nasdaq finished with a small doji which is perhaps a little nod to bulls, but it would be a stretch to say today was a bullish day.

The Russell 2000 went the other way and lost a little ground. However, with the 200-day MA holding as support there is no immediate concern on the loss. I would watch for a doji or bullish hammer tagging converged 20-day MA and 50-day MAs; this may become a buying opportunity.

For tomorrow, markets need to kick-on from the current malaise. Things have gone quiet, and when markets go quiet - they drift - and this typically leads to lower prices.

You've now read my opinion, next read Douglas' blog.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

Investments are held in a pension fund on a buy-and-hold strategy.

.

The Russell 2000 went the other way and lost a little ground. However, with the 200-day MA holding as support there is no immediate concern on the loss. I would watch for a doji or bullish hammer tagging converged 20-day MA and 50-day MAs; this may become a buying opportunity.

For tomorrow, markets need to kick-on from the current malaise. Things have gone quiet, and when markets go quiet - they drift - and this typically leads to lower prices.

You've now read my opinion, next read Douglas' blog.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

.