Semiconductors enjoy biggest gain

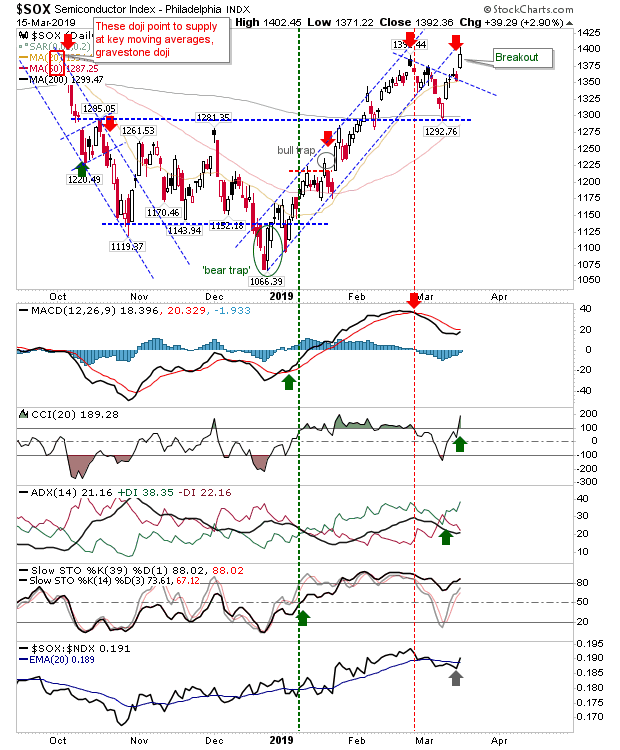

There wasn't a whole to Friday's action but Semiconductors did enough to negate the two potential short plays on offer as it managed a new closing high for the December - March rally.

Semiconductors enjoyed a relative performance gain against the Nasdaq 100 which should ultimately help the latter index (and the Nasdaq). The CCI returned to bullish territory but the MACD is going to need a couple more days of gain to switch 'bullish'.

The S&P has almost negated the earlier 'bull trap' and enjoyed higher volume accumulation, enough to trigger a 'buy' in On-Balance-Volume. Relative performance of the index continued to outperform the Russell 2000 as money rotates out of speculative, small caps to more traditional, large cap stocks.

The Nasdaq did manage a new closing high on higher volume accumulation. Like the S&P it still has a MACD trigger 'sell' to reverse but Friday's Semiconductor Index action should help push this index higher.

The Russell 2000 retained its potential short play as its 20-day MA held as resistance. Relative performance has taken a sharp turn lower which should help shorts and Friday's small, but inverse hammer points to supply problems on attempts to break through the moving average.

For Monday, look to see what impact the big push in the Semiconductors does for the Nasdaq and Nasdaq 100. If there is opening weakness, then the Russell 2000 will be most vulnerable to a shorts attack.

I have added two new trade candidates for Monday and an update on the existing five currently in play.

You've now read my opinion, next read Douglas' blog.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

Investments are held in a pension fund on a buy-and-hold strategy.

.

Semiconductors enjoyed a relative performance gain against the Nasdaq 100 which should ultimately help the latter index (and the Nasdaq). The CCI returned to bullish territory but the MACD is going to need a couple more days of gain to switch 'bullish'.

The S&P has almost negated the earlier 'bull trap' and enjoyed higher volume accumulation, enough to trigger a 'buy' in On-Balance-Volume. Relative performance of the index continued to outperform the Russell 2000 as money rotates out of speculative, small caps to more traditional, large cap stocks.

The Nasdaq did manage a new closing high on higher volume accumulation. Like the S&P it still has a MACD trigger 'sell' to reverse but Friday's Semiconductor Index action should help push this index higher.

The Russell 2000 retained its potential short play as its 20-day MA held as resistance. Relative performance has taken a sharp turn lower which should help shorts and Friday's small, but inverse hammer points to supply problems on attempts to break through the moving average.

For Monday, look to see what impact the big push in the Semiconductors does for the Nasdaq and Nasdaq 100. If there is opening weakness, then the Russell 2000 will be most vulnerable to a shorts attack.

I have added two new trade candidates for Monday and an update on the existing five currently in play.

You've now read my opinion, next read Douglas' blog.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

.