Monday's gains consolidated

There wasn't a whole lot to add to today's action but the best thing that could be said was that yesterday's gains held.

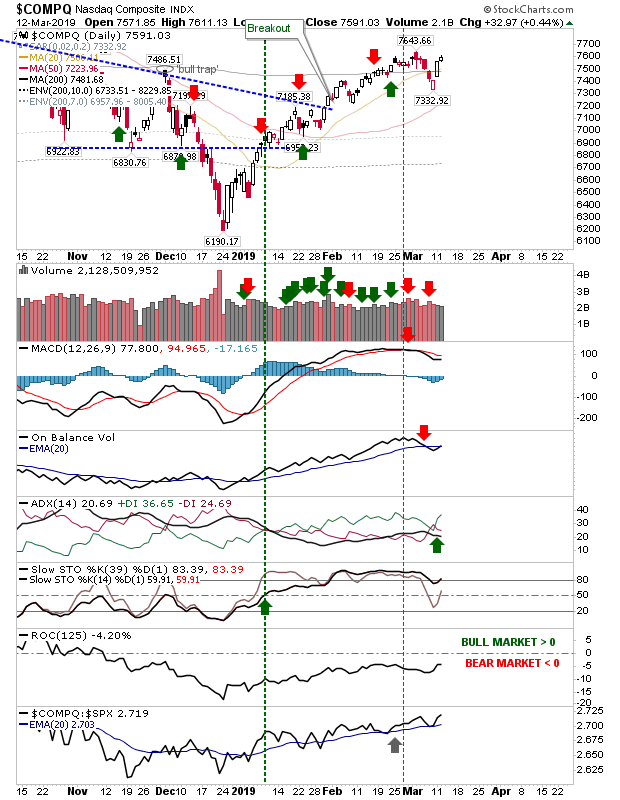

The Nasdaq added near 0.5% as prior 'sell' triggers began to reverse; first was +DI/-DI. However, On-Balance-Volume and the MACD are still on 'sell' triggers. Relative performance has also managed a new multi-month high, perhaps enough to help break the 7,643 high.

The S&P is in the early stages of challenging the March 'bull trap'. Like the Nasdaq it managed to reverse the 'sell' trigger in +DI/-DI and enjoyed a significant relative performance advance against the Russell 2000.

The Russell 2000 just edged a bullish cross of its +DI/-DI but still has significant ground to make up if it's to challenge the last swing high in February and its 200-day MA. It also has to deal with a sharp drop in relative performance as money flows into safer Large Cap indices.

The Nasdaq 100 has actually managed to edge above the last high, which is good new for those looking for similar breaks in peer indices. Relative performance is good. There were also new 'buy' triggers in +DI/-DI and On-Balance-Volume.

While today's gains were small the intention was positive. The December low has the look of a major swing low, the question is how much retracement (if any) will we see over the coming months in confirming this low.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The Nasdaq added near 0.5% as prior 'sell' triggers began to reverse; first was +DI/-DI. However, On-Balance-Volume and the MACD are still on 'sell' triggers. Relative performance has also managed a new multi-month high, perhaps enough to help break the 7,643 high.

The S&P is in the early stages of challenging the March 'bull trap'. Like the Nasdaq it managed to reverse the 'sell' trigger in +DI/-DI and enjoyed a significant relative performance advance against the Russell 2000.

The Russell 2000 just edged a bullish cross of its +DI/-DI but still has significant ground to make up if it's to challenge the last swing high in February and its 200-day MA. It also has to deal with a sharp drop in relative performance as money flows into safer Large Cap indices.

The Nasdaq 100 has actually managed to edge above the last high, which is good new for those looking for similar breaks in peer indices. Relative performance is good. There were also new 'buy' triggers in +DI/-DI and On-Balance-Volume.

While today's gains were small the intention was positive. The December low has the look of a major swing low, the question is how much retracement (if any) will we see over the coming months in confirming this low.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.