Oh Apple...

I was going to say how well markets did to finish near highs after pre-market action has indicated a possible rout but now we have Apple after-hours earnings report contributing to a 7%+ loss...

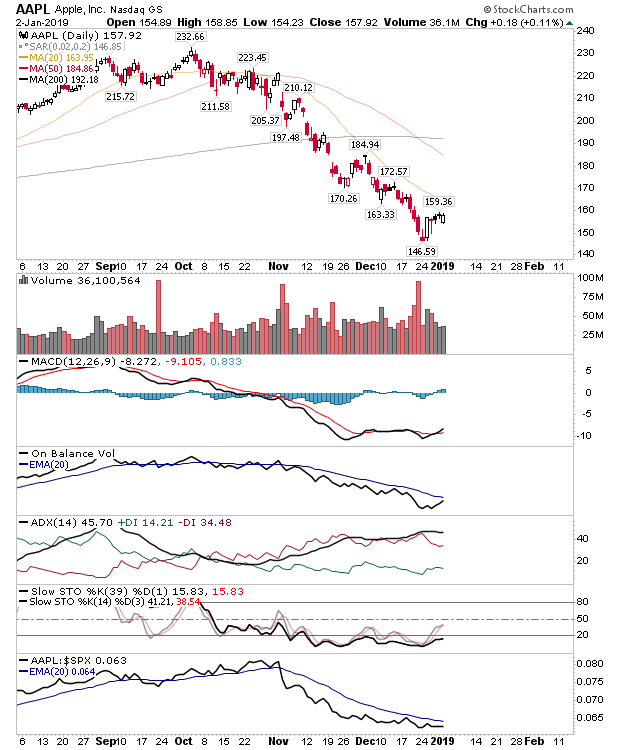

An open at 146s would start the stock at the December swing low but the trend is clearly down and technicals - aside from the MACD trigger 'buy' - are not offering any bullish divergence.

What this means for markets tomorrow remains to be seen, but if markets can finish above its (likely gap down) open price it would firm up a swing low. The index posted a MACD trigger 'buy'.

The S&P has support at 2,346 to lean on; it should be good enough to open above 2,346 but can it finish higher? There was also a MACD trigger 'buy'.

The Russell 2000 also had its MACD trigger 'buy' but as having sold off harder than other indices it's offering the best discount value. Going out on a limb and suggesting this index might be okay tomorrow.

For tomorrow, pre-market will set the tone but if it can generate a day like today then this swing low will have confirmed its resilience.

Again, long-term investors will be given another golden opportunity to add to existing positions.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

An open at 146s would start the stock at the December swing low but the trend is clearly down and technicals - aside from the MACD trigger 'buy' - are not offering any bullish divergence.

What this means for markets tomorrow remains to be seen, but if markets can finish above its (likely gap down) open price it would firm up a swing low. The index posted a MACD trigger 'buy'.

The S&P has support at 2,346 to lean on; it should be good enough to open above 2,346 but can it finish higher? There was also a MACD trigger 'buy'.

The Russell 2000 also had its MACD trigger 'buy' but as having sold off harder than other indices it's offering the best discount value. Going out on a limb and suggesting this index might be okay tomorrow.

For tomorrow, pre-market will set the tone but if it can generate a day like today then this swing low will have confirmed its resilience.

Again, long-term investors will be given another golden opportunity to add to existing positions.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter