Not Great, But Not Bad Either...

Apple's earnings disappointment had set the market up for turmoil, but again, markets were able to hold up against expected weakness. After December's fall into 'Strong Buy' territory, we now have a market immune to bad news which for investors means they can keep on buying.

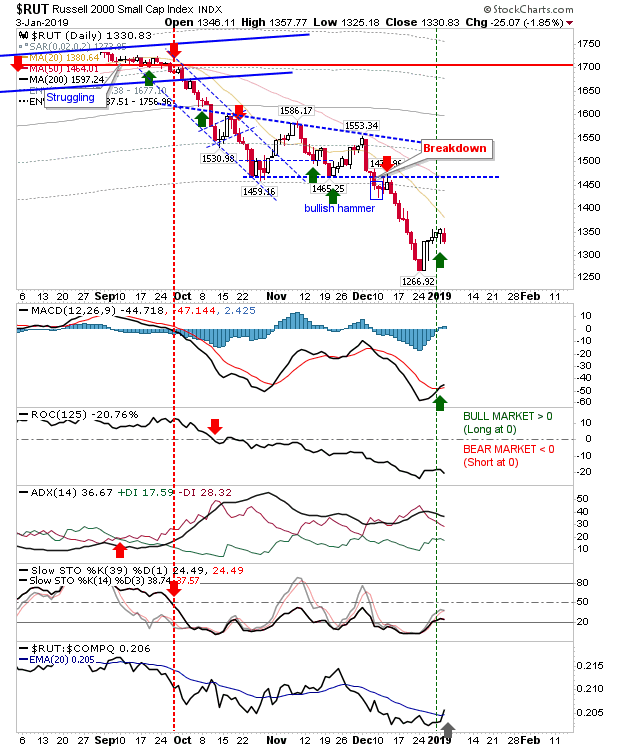

I had looked to the Russell 2000 to be the next market leader and today's losses weren't enough to reverse a prior relative performance gain against the Nasdaq and S&P. Days like today are typically followed by a loss, which here is ultimately a retest of 1,266. Should this happen, traders can protect themselves with GTC buy orders set around 1,270.

The S&P maintained its MACD trigger 'buy' as it suffered a relative loss against the Russell 2000; as with the aforementioned index it favors a retest of the swing low at 2,346. The move to retest the low is supported by a 'sell' trigger in relative performance against Small Caps despite the 'buy' trigger in the MACD.

The Nasdaq is caught in the middle. There is a relative performance weakness against the Nasdaq but 'buy' triggers for the MACD and On-Balance-Volume. While not as weak as Large Caps there is still a preferred move to the swing low at 6,190.

For breadth metrics we have a deep oversold condition for the Nasdaq, deeper than lows of 2016 and not far off those of 2009.

and a surge in new lows, well beyond levels associated with the 2016 swing low.

For tomorrow, investors can keep buying and near-term buyers can start fishing for trades too.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

I had looked to the Russell 2000 to be the next market leader and today's losses weren't enough to reverse a prior relative performance gain against the Nasdaq and S&P. Days like today are typically followed by a loss, which here is ultimately a retest of 1,266. Should this happen, traders can protect themselves with GTC buy orders set around 1,270.

The S&P maintained its MACD trigger 'buy' as it suffered a relative loss against the Russell 2000; as with the aforementioned index it favors a retest of the swing low at 2,346. The move to retest the low is supported by a 'sell' trigger in relative performance against Small Caps despite the 'buy' trigger in the MACD.

The Nasdaq is caught in the middle. There is a relative performance weakness against the Nasdaq but 'buy' triggers for the MACD and On-Balance-Volume. While not as weak as Large Caps there is still a preferred move to the swing low at 6,190.

For breadth metrics we have a deep oversold condition for the Nasdaq, deeper than lows of 2016 and not far off those of 2009.

and a surge in new lows, well beyond levels associated with the 2016 swing low.

For tomorrow, investors can keep buying and near-term buyers can start fishing for trades too.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter