A mixed bag of action. Long-term investors can look to the losses in the Russell 2000 and Nasdaq as another accumulation opportunity but if you bought Thursday's bullish piercing pattern of the Nasdaq as a near-term trading opportunity you will likely have been stopped out - or feeling ready to flee.

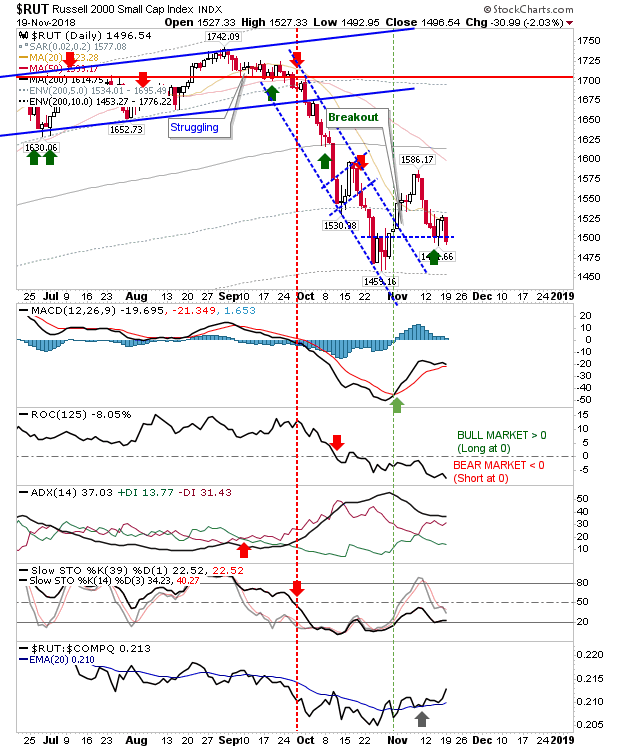

As a trading opportunity, the Russell 2000 is just above its stop zone (loss of Thursday's piercing pattern low). The MAD is still holding its 'buy' trigger along with its relative performance advantage, but ROC is accelerating lower - moving deeper into bear market territory. Investors shouldn't fear the noise and keep on dabbling a little here and there on the buy side.

The Nasdaq undercut the piercing swing low on an end-of-day close which is probably enough to trigger most trader's stops. From an investor standpoint, it's 6.5% below its 200-day MA and just crept into an investing 'buy' opportunity - its first since February 2016 - although after today's close further losses look likely.

The S&P is in a bit of a halfway house. It hasn't dropped far enough to warrant investor interest or negated last Thursday's bullish piercing pattern. Aggressive traders could probably look to buy with a stop on a loss of 2,670. Relative performance is still good and the MACD is clinging on to it earlier 'buy' trigger.

Of other indices, the Nasdaq 100 made it back to former channel resistance - now support - for another buying opportunity. However, this now comes with a fresh 'sell' trigger along with another tick lower in relative performance.

The Semiconductor Index took a big hit and is looking like it will move lower. Surprisingly, technicals are looking better with positive CCI, MACD and relative performance.

For tomorrow, traders can look to take advantage of the retracement to nick an aggressive 'buy' in the S&P, Russell 2000, and even the Nasdaq 100. However, given what happened in the Nasdaq the likelihood for these trades getting stopped out is quite high. Investors shouldn't carry the same fear but keep the trades small and frequent, particularly on days when markets record losses above 1%.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for education on

eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.