Semiconductors Index Breakout but Dow at Channel Resistance as Small Caps Breakdown

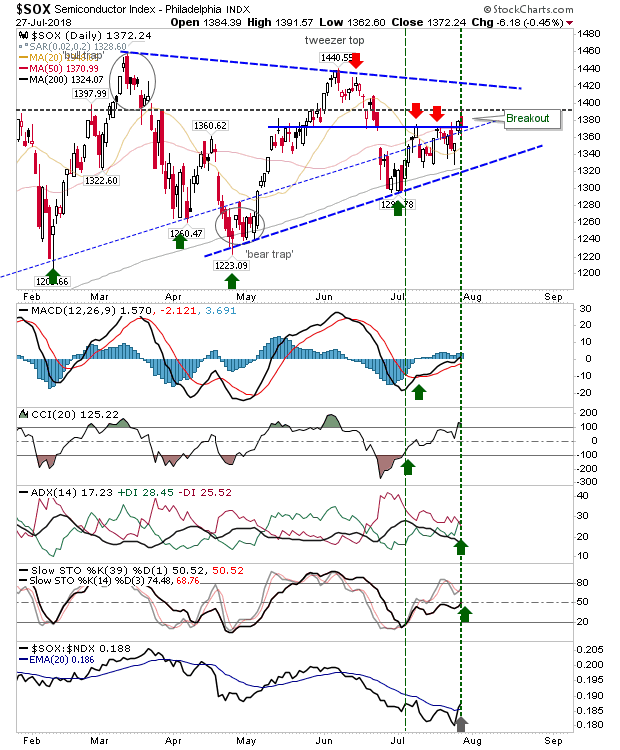

Lots of divergences in play across the markets. Start with the positives, the Semiconductor Index edged above resistance in what looks like breakout. It lost ground Friday which suggests it may still require a redrawing of resistance if this is some form of rising channel. However, in the near term, this looks like a genuine breakout and look for a move to triangle resistance.

It wasn't all good news. The Russell 2000 took a big hit as rising channel support was broken in a decisive move lower. The index finished just below its 50-day MA, which is still a possible support level. Technicals are mixed but there may be enough support to see the 200-day MA hold as support if the 50-day MA don't.

The Nasdaq also finished down at its 50-day MA but in doing so left a 'bull trap'; shorts will look to attack rallies back to 7,800. Volume dropped a little but there were bearish technicals for +DI/-DI, On-Balance-Volume and MACD. On Monday, don't be surprised if there is an intraday spike low down to the 200-day MA but a close above 7,737.

Not a whole lot to add for the S&P, the index is holding within its rising channel and while it lost ground Friday it didn't come near any major support levels.

However, the Dow Jones Industrial Average is at channel resistance for what looks like a shorting opportunity. Technicals are all positive so a breakout is perhaps favored.

For tomorrow, the Semiconductor Index has the cleanest breakout and assuming it doesn't tall back into the prior consolidation it will have an opportunity to rally into channel resistance. The 50:50 play is the Dow Jones Index; it's at channel resistance - a preferred short - but technicals suggest there is more upside. The Russell 2000 marked a clear breakdown after a failed attempt to the challenge the swing high; shorts have perhaps the best opportunity here.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.I invest in my pension fund as a buy-and-hold.

.

It wasn't all good news. The Russell 2000 took a big hit as rising channel support was broken in a decisive move lower. The index finished just below its 50-day MA, which is still a possible support level. Technicals are mixed but there may be enough support to see the 200-day MA hold as support if the 50-day MA don't.

The Nasdaq also finished down at its 50-day MA but in doing so left a 'bull trap'; shorts will look to attack rallies back to 7,800. Volume dropped a little but there were bearish technicals for +DI/-DI, On-Balance-Volume and MACD. On Monday, don't be surprised if there is an intraday spike low down to the 200-day MA but a close above 7,737.

Not a whole lot to add for the S&P, the index is holding within its rising channel and while it lost ground Friday it didn't come near any major support levels.

However, the Dow Jones Industrial Average is at channel resistance for what looks like a shorting opportunity. Technicals are all positive so a breakout is perhaps favored.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.I invest in my pension fund as a buy-and-hold.

.