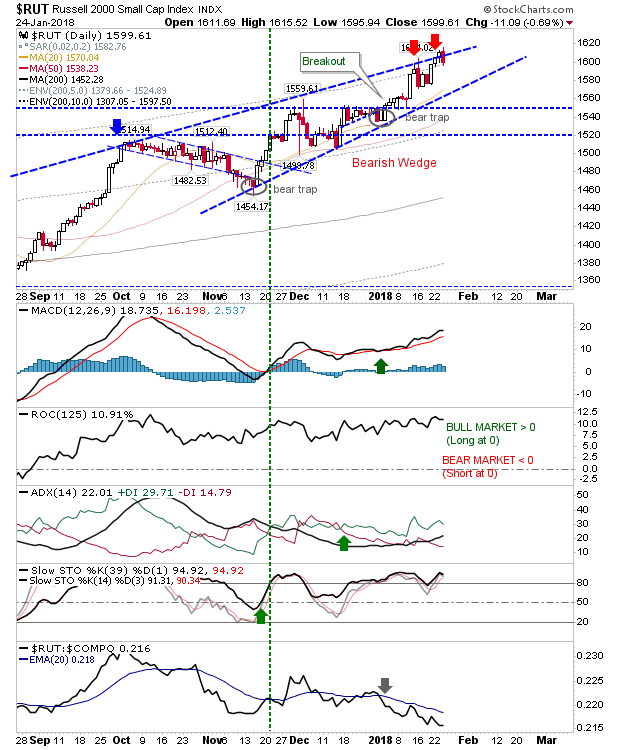

Bearish Wedge in Russell 2000?

It's a bit of a grasp given strength across markets but the Russell 2000 may be shaping a bearish wedge. There are three tags of resistance but it's rising support anchored by the two 'bear traps' which suggests a possible wedge. Today's bearish engulfing pattern also contributes.

The S&P remains inside its narrow ascending channel, today's losses didn't change that even though the day registered as a distribution day.

Ditto for the Nasdaq

The Semiconductor Index gapped lower, opening the possibility for a bearish 'shooting star' top; for this to be true today's breakdown gap can't be challenged or closed (short-stops go above Monday's high.

Today's selling is a warning sign but not any reason for undue concern. Shorts may get the best of the action from the Russell 2000 or Semiconductor Index. It's too late to be buying anything here so a solid bout of weakness would be welcoming for wannabe longs.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The S&P remains inside its narrow ascending channel, today's losses didn't change that even though the day registered as a distribution day.

Ditto for the Nasdaq

The Semiconductor Index gapped lower, opening the possibility for a bearish 'shooting star' top; for this to be true today's breakdown gap can't be challenged or closed (short-stops go above Monday's high.

Today's selling is a warning sign but not any reason for undue concern. Shorts may get the best of the action from the Russell 2000 or Semiconductor Index. It's too late to be buying anything here so a solid bout of weakness would be welcoming for wannabe longs.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

. I invest in my pension fund as a buy-and-hold.