Volatility took a tick higher with profit taking sweeping across the broad before buyers zipped it all back up. Trump's Russian investigation will add a level of uncertainty to the Tax Cut rally and markets may take another trip into Friday's intraday low; should markets deliver a lower close Monday then it could turn into an ugly week as traders will need to defend Friday's lows

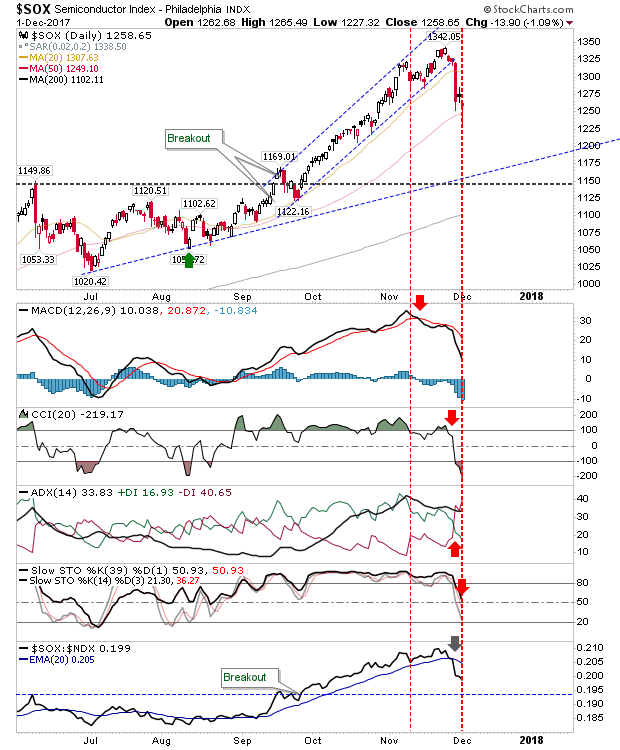

The Semiconductor Index was hardest hit last week but it was able to dig in at its 50-day MA and finish the week above this key moving average. If there is going to be a rally I would look to this index to deliver simply because it suffered the hardest level of selling and should be the most amenable to a recovery rally.

Large Caps didn't escape the selling but unlike other indices they didn't drop into prior advances. The S&P and Dow (the latter in particular) are well above support and still high enough to keep longs predominantly in control with bullish technicals.

The Russell 2000 tagged its 50-day MA at the low of the day and some lucky traders will be holding profits on buying the test. Technicals are a little mixed with a 'sell' trigger in the ADX offset by bullish MACD, Stochastics and Relative Performance (vs the Nasdaq).

The Nasdaq reversed off converged resistance from the primary and secondary (accelerated) channel. Friday's intraday low did enough to tag secondary channel support which may be the spring board for a rally. However, another run at secondary channel support on Monday is likely to lead to a channel breakdown and set up for a move to primary channel support (thin hashed blue line).

In terms of the long term charts, there was a picture perfect bounce off channel support for the relative relationship between Transports and Dow Jones Industrials creating an environment for a 'bear trap'. If this can follow through higher then it will be good news for Transports (and the economy at large).

For tomorrow, premarket leads will be important. A gap down will make any subsequent rally difficult to hold. Indices are in need of a purge to shake out weak-hand longs but with seasonal factors ("Santa Rally") in play it may yet be another couple of months before sellers can dominate the market.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on

eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.