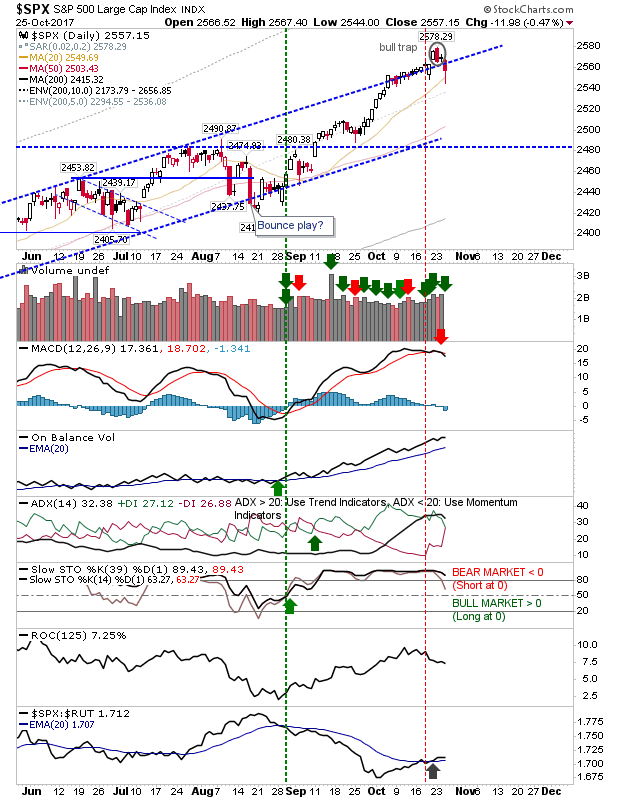

Bull Trap in S&P?

The week started with some profit taking which extended through to today. The only index to be negatively impacted by this was the S&P. Whether today's selling, which undercut former channel resistance to leave a 'bull trap', turns into anything significant to worry about remains to be seen. Recent trading volume has favoured buyers, with On-Balance-Volume showing very strong accumulation since August. The MACD has shown a 'sell' trigger but the 20-day MA has offered a point of support; a deeper pullback to the 50-day MA would still maintain the bullish trend so there is plenty of room for buyers to remain interested.

The selling in the Nasdaq came back to the 20-day MA. The 20-day MA is running inside the rising channel so the selling doesn't really change anything for this index. There are 'sell' triggers for the MACD and +DI/-DI and there is distribution volume to boot but until lower channel support is broken (somewhere between 6,450 and 6,500) there isn't too much of concern here.

The Russell 2000 had broken upside from what had looked to be a tight 'bull flag' but this looks to be evolving into a wider 'bull flag'. There was a new 'sell' trigger in the +DI/-DI to go with the evolving 'sell' trigger in the MACD. The index also undercut the 20-day MA. This may take a little while longer before there is a new upside break.

The Dow Jones Index resisted the selling and hasn't yet broken the upward trend; it remains the most bullish of the indices.

In terms of a value trade, the Nasdaq 100 might offer something for tomorrow. Today's low was close to a converged support level of psychological 6,000 support and rising channel. The index did enough to make it back to its 20-day MA which gives bulls something to work with; stops on a loss of 6,000.

For tomorrow, keep an eye on the Nasdaq 100 if looking for long positions and the S&P for short positions - although the latter would only be for a short term move to channel support.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The selling in the Nasdaq came back to the 20-day MA. The 20-day MA is running inside the rising channel so the selling doesn't really change anything for this index. There are 'sell' triggers for the MACD and +DI/-DI and there is distribution volume to boot but until lower channel support is broken (somewhere between 6,450 and 6,500) there isn't too much of concern here.

The Russell 2000 had broken upside from what had looked to be a tight 'bull flag' but this looks to be evolving into a wider 'bull flag'. There was a new 'sell' trigger in the +DI/-DI to go with the evolving 'sell' trigger in the MACD. The index also undercut the 20-day MA. This may take a little while longer before there is a new upside break.

The Dow Jones Index resisted the selling and hasn't yet broken the upward trend; it remains the most bullish of the indices.

In terms of a value trade, the Nasdaq 100 might offer something for tomorrow. Today's low was close to a converged support level of psychological 6,000 support and rising channel. The index did enough to make it back to its 20-day MA which gives bulls something to work with; stops on a loss of 6,000.

For tomorrow, keep an eye on the Nasdaq 100 if looking for long positions and the S&P for short positions - although the latter would only be for a short term move to channel support.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.