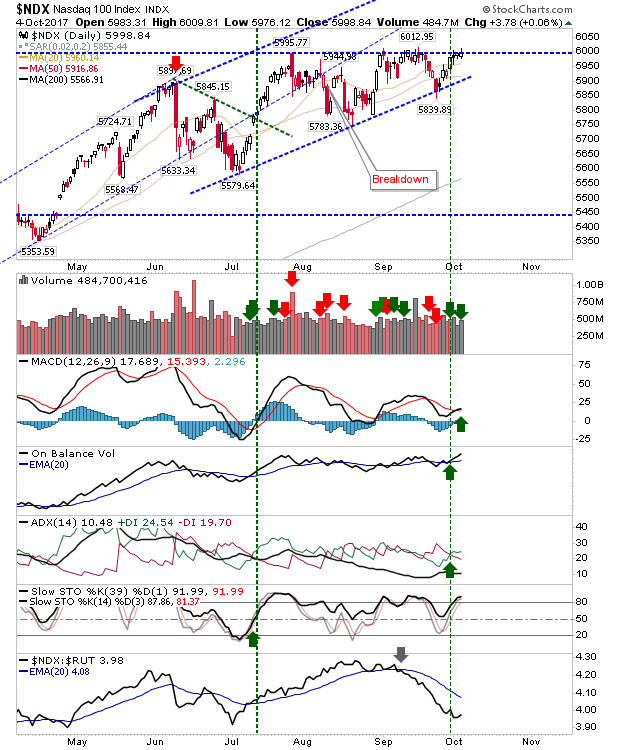

And the wait goes on (for the Nasdaq 100)...

The index which looked ready to the pop spent another day on the sidelines. There is little room for maneuver for either side so if the Nasdaq 100 doesn't pop tomorrow it's hard to know when it will. Volume climbed in accumulation and the MACD triggered a new 'buy'.

The S&P came very close to tagging channel resistance and today's action came as close as to registering a channel hit. Technicals are healthy although a volume was a little light.

The Russell 2000 lost a little ground but this was to be expected given prior gains. Look for more of the same.

The one index is heading towards resistance is the relative relationship between Consumer Staples (XLP) and Consumer Discretionary (XLY). Profit takers take note, now is the time to take some money off the table.

For tomorrow, the index to watch is the Nasdaq 100 but the S&P may be one for which taking some money off the table looks the more prudent action.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The S&P came very close to tagging channel resistance and today's action came as close as to registering a channel hit. Technicals are healthy although a volume was a little light.

The Russell 2000 lost a little ground but this was to be expected given prior gains. Look for more of the same.

The one index is heading towards resistance is the relative relationship between Consumer Staples (XLP) and Consumer Discretionary (XLY). Profit takers take note, now is the time to take some money off the table.

For tomorrow, the index to watch is the Nasdaq 100 but the S&P may be one for which taking some money off the table looks the more prudent action.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.