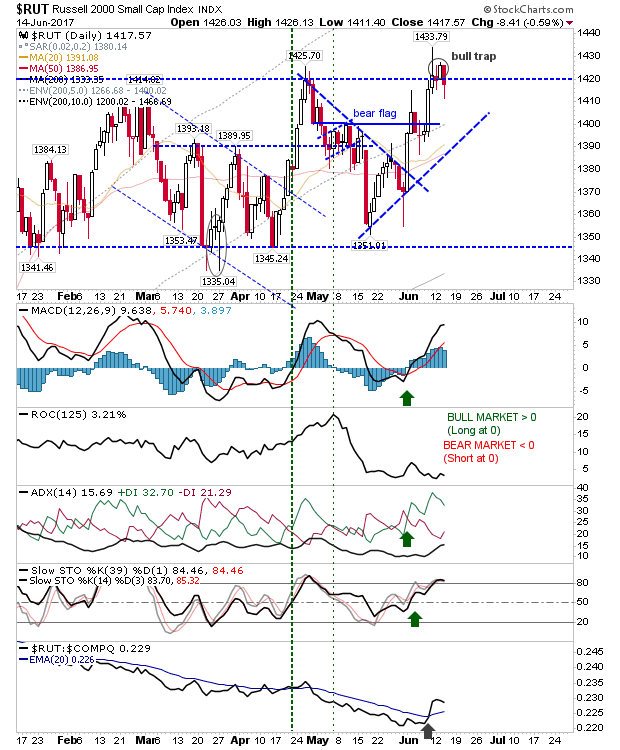

Upcoming "Death Cross" for Russell 2000 ($IWM)

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see where the buyers are going to come from given the chaos of Trump. I should add, I listened to Josh Brown's The Compound podcast and he showed an interesting chart of market returns in April-May in the year following a strong return in markets; in essence, selling to pay capital gains tax. Given the precarious nature of markets, and the possibility for this seasonal factor to play out, it's likely we have a couple more months of downward action before value buyers return. If we look at individual markets, the Russell 2000 ($IWM) is looking like the first to signal a long term shift in favor of bears with an upcoming "Death Cross" between the 50-day MA and 200-day MA - perhaps completing before the end of the week. Technicals are net bearish and the volume trend has collapsed since the st...