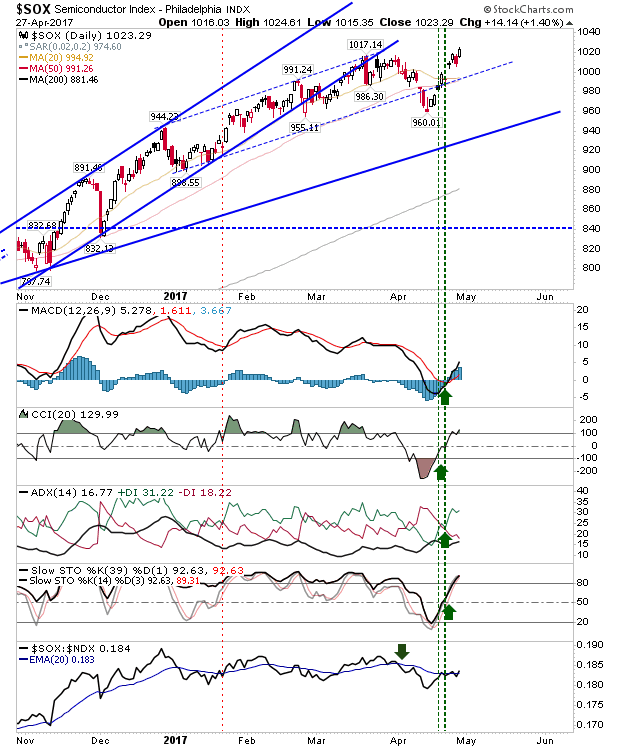

Semiconductors Tick Along

It was another quiet day for indices but the Semiconductor index was able to add over 1% on the day. This also helped post gains to the Nasdaq 100, although there was a relative gain for the Semiconductor Index against the latter index.

The Nasdaq 100 registered an accumulation day despite its underperformance against Small Caps. The index remains well placed to make a move to upper channel resistance.

The Russell 2000 is outperforming against the Nasdaq while it registered a small loss on the day. Those looking for a pullback 'buy' opportunity may be rewarded early next week. Technicals remain in excellent shape.

For the sake of inclusion, there was nothing to say about the doji in the S&P.

For tomorrow, momentum players can continue to focus on Tech indices and Semiconductors. Value players can look to take advantage of any additional weakness in the Russell 2000. Everything else is a hold, while Shorts need to remain on the sidelines - although aggressive ones may want to try for a double top in the S&P, unlikely though this looks.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The Nasdaq 100 registered an accumulation day despite its underperformance against Small Caps. The index remains well placed to make a move to upper channel resistance.

The Russell 2000 is outperforming against the Nasdaq while it registered a small loss on the day. Those looking for a pullback 'buy' opportunity may be rewarded early next week. Technicals remain in excellent shape.

For the sake of inclusion, there was nothing to say about the doji in the S&P.

For tomorrow, momentum players can continue to focus on Tech indices and Semiconductors. Value players can look to take advantage of any additional weakness in the Russell 2000. Everything else is a hold, while Shorts need to remain on the sidelines - although aggressive ones may want to try for a double top in the S&P, unlikely though this looks.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.