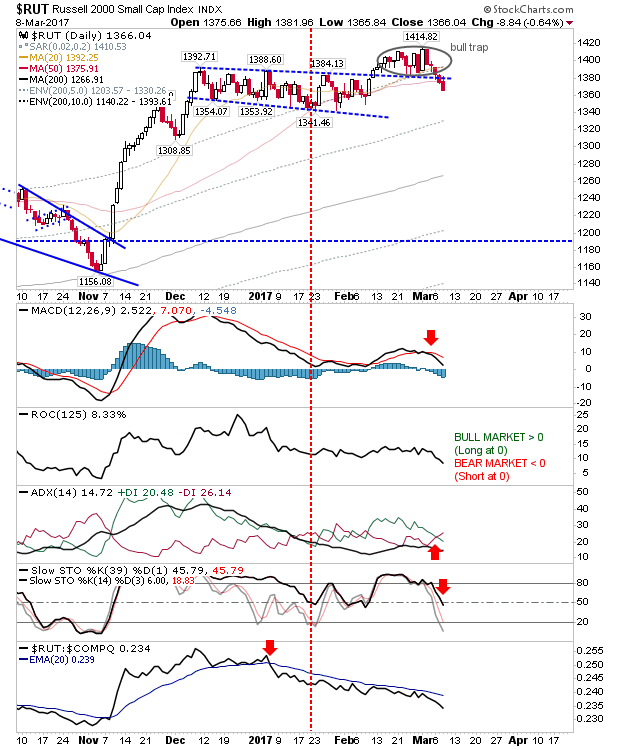

Small Caps Accelerate Losses

A mixed day with most indices experiencing minimal change. The only index to come out feeling blue was the Russell 2000. Yesterday's selling confirmed a 'bull trap' and today saw some follow through with sellers continuing to pressure. The next rally will be critical; will it be attacked shorts? Or will bulls breeze past 1,414? Other indices will be looking to the Russell 2000 for leads.

Next on the chopping block is the S&P. Today's losses were relatively minor, but the index did rack up a distribution day - one of five consecutive loss days for the index. Bulls can look to the 20-day MA at 2,355 as a possible launch point for a rally.

The Nasdaq actually managed a tiny gain - which meant today's higher volume counts as accumulation. But really, it was another day of holding the status quo and staying out of the limelight. There is bearish creep with the MACD trigger 'sell', but there is also a relative improvement against its peers.

However, supporting breadth metrics continue to deteriorate. The latest is the Nasdaq Summation Index which is now net bearish in technical strength.

For tomorrow, look for a bullish response in the S&P, but failing that, watch for further losses in the Russell 2000 as profit taking looks to accelerate.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

Next on the chopping block is the S&P. Today's losses were relatively minor, but the index did rack up a distribution day - one of five consecutive loss days for the index. Bulls can look to the 20-day MA at 2,355 as a possible launch point for a rally.

The Nasdaq actually managed a tiny gain - which meant today's higher volume counts as accumulation. But really, it was another day of holding the status quo and staying out of the limelight. There is bearish creep with the MACD trigger 'sell', but there is also a relative improvement against its peers.

However, supporting breadth metrics continue to deteriorate. The latest is the Nasdaq Summation Index which is now net bearish in technical strength.

For tomorrow, look for a bullish response in the S&P, but failing that, watch for further losses in the Russell 2000 as profit taking looks to accelerate.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.