Buyers Come Back To 20-Day MAs

With indices experiencing small changes, 20-day MAs are starting to look like a defensive point for bulls to work the next rally.

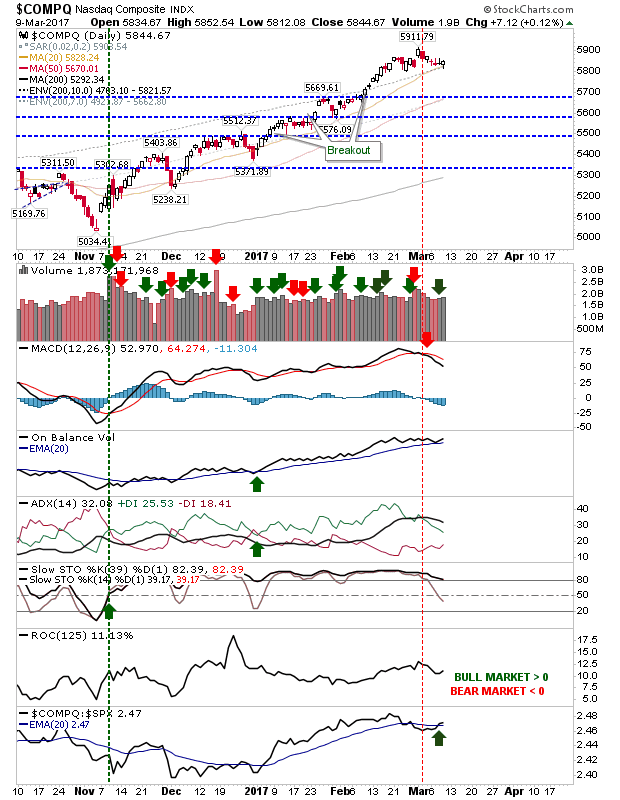

The Nasdaq finished higher after a defensive push off its 20-day MA. This didn't make any significant changes to the technical picture, but it does suggest the possibility a new swing low is in play.

It was a similar story for the S&P. It closed on a neutral doji right on its 20-day MA. Technicals are okay, but the MACD trigger 'sell' is now well established.

The Dow Jones Index is also at the 20-day MA. It too has a MACD 'sell' trigger to overcome, but it has a good past trend to leverage and is close to an On-Balance-Volume 'sell' trigger

The Russell 2000 index continues to struggle, but despite a series of losses it's not yet oversold. Relative weakness of the index against the Nasdaq took a step lower as the index struggles to attract value buyers. Look for worse to follow.

For tomorrow, look for further positive actions from Large Caps and Tech. Small Caps are struggling for attention, but if buyers do step in, then Small Caps could make the biggest relative gain of all indices.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.

The Nasdaq finished higher after a defensive push off its 20-day MA. This didn't make any significant changes to the technical picture, but it does suggest the possibility a new swing low is in play.

It was a similar story for the S&P. It closed on a neutral doji right on its 20-day MA. Technicals are okay, but the MACD trigger 'sell' is now well established.

The Dow Jones Index is also at the 20-day MA. It too has a MACD 'sell' trigger to overcome, but it has a good past trend to leverage and is close to an On-Balance-Volume 'sell' trigger

The Russell 2000 index continues to struggle, but despite a series of losses it's not yet oversold. Relative weakness of the index against the Nasdaq took a step lower as the index struggles to attract value buyers. Look for worse to follow.

For tomorrow, look for further positive actions from Large Caps and Tech. Small Caps are struggling for attention, but if buyers do step in, then Small Caps could make the biggest relative gain of all indices.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.