First Week of 2017 Ends on High

The bright start to the year continued as bulls were able to maintain buying pressure for three of the four first trading days of the year.

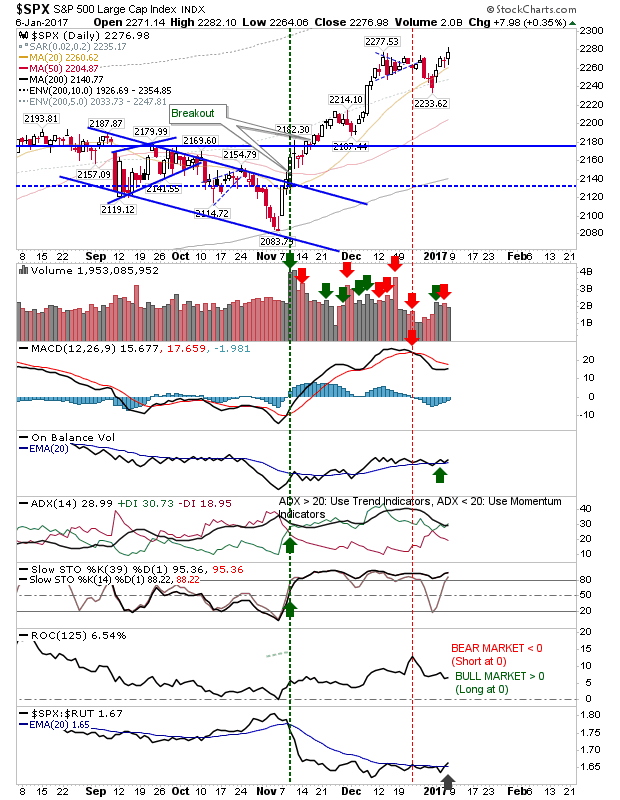

The S&P closed near the highs of 2016 with all key moving averages in upward trends. The MACD is still holding to a 'sell' trigger, but this is heading towards a new 'buy' trigger, which given the strong position relative to the zero line would instead register as a pullback 'buying' opportunity.

The Nasdaq made a standard breakout as it attempts to re-assert a leadership role against the S&P. On-Balance-Volume hasn't yet cleared a new high and the MACD still has a 'sell' trigger to navigate. The only low point was the falling volume on the week's rally and breakout, but this can be expected as traders slowly make their way back after the holidays.

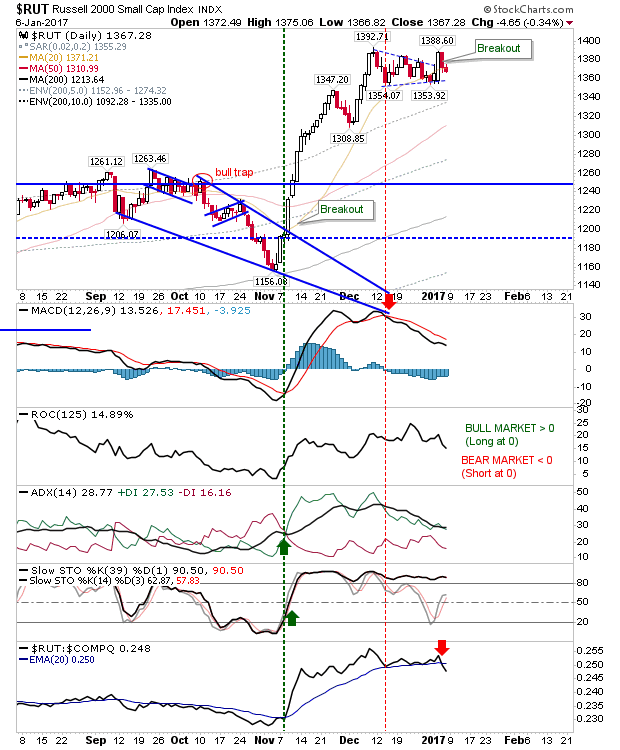

The Russell 2000 had an understated week. It closed lower on Friday after the effects of Thursday's selling continued. Not surprisingly, this action has seen relative performance shift sharply away from Small Cap stocks. This may be a bit of a warning sign as money shifts from speculative to more defensive (S&P) stocks, but with the Nasdaq performing well such doubts may yet prove unfounded.

Monday should see the true start of the New Year with all traders back from their vacation. The prognosis looks good for bulls and market watches should look to the S&P and Dow following the lead of Tech indices last week (and breaking higher). If the reverse happens - and Tech indices drop below breakout lows - then these will become aggressive short plays (with stops going just above Friday's highs).

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P closed near the highs of 2016 with all key moving averages in upward trends. The MACD is still holding to a 'sell' trigger, but this is heading towards a new 'buy' trigger, which given the strong position relative to the zero line would instead register as a pullback 'buying' opportunity.

The Nasdaq made a standard breakout as it attempts to re-assert a leadership role against the S&P. On-Balance-Volume hasn't yet cleared a new high and the MACD still has a 'sell' trigger to navigate. The only low point was the falling volume on the week's rally and breakout, but this can be expected as traders slowly make their way back after the holidays.

The Russell 2000 had an understated week. It closed lower on Friday after the effects of Thursday's selling continued. Not surprisingly, this action has seen relative performance shift sharply away from Small Cap stocks. This may be a bit of a warning sign as money shifts from speculative to more defensive (S&P) stocks, but with the Nasdaq performing well such doubts may yet prove unfounded.

Monday should see the true start of the New Year with all traders back from their vacation. The prognosis looks good for bulls and market watches should look to the S&P and Dow following the lead of Tech indices last week (and breaking higher). If the reverse happens - and Tech indices drop below breakout lows - then these will become aggressive short plays (with stops going just above Friday's highs).

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.