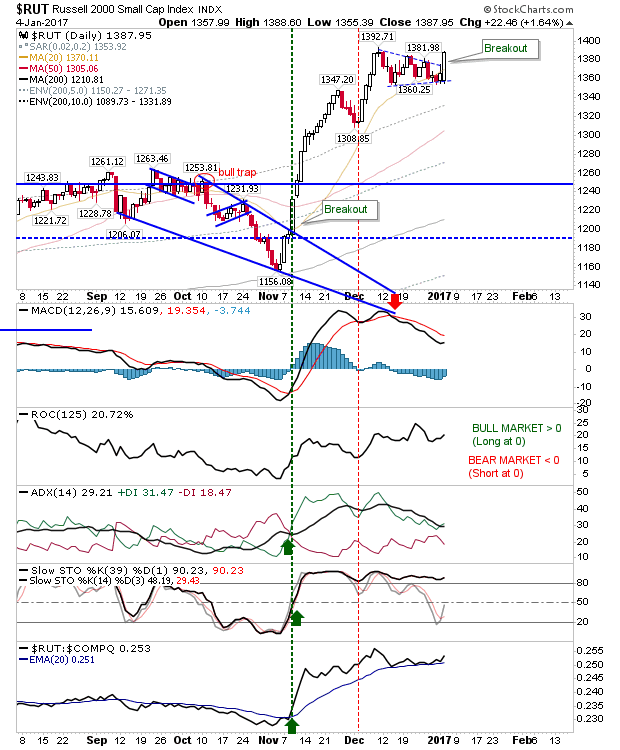

End-of-year profit taking has given way to start-of-year buying. The best performer on the day was the Russell 2000. It gained over 1.5% as it broke upside from its consolidation. While the gain did little to reverse the MACD 'sell' trigger it does look like action has kicked off a measured move higher.

The S&P booked a second consecutive day of gains. This move higher came on lighter volume, and didn't change the technical picture greatly, only an On-Balance-Volume 'buy' trigger to report.

The Nasdaq finds itself challenging resistance tomorrow. Of the indices it has the weakest technicals, but today's buying was enough to reverse the 'sell' trigger in On-Balance-Volume, which also coincided with trading volume comparable to yesterday's.

While the Nasdaq has been a bit of a laggard it has been assisted by strength in the semiconductor index. The 'sell' triggers in MACD and CCI run contrary to what looks like a bullish inside day for price action (a long trade with a stop below 899 might be the perfect tonic).

It's becoming hard to see how bears will gain an angle. The easy option for a straight sell off now moves further away than ever before. Even what had been relatively bearish long-term weekly charts are fighting higher. For example, the relationship between Consumer Staples and Discretionary is slowly moving back in bulls favour (although it never moved oversold enough to suggest a strong bottom).

Although those late to the game may want to take a look at the Transports index. A buying opportunity looks sustainable from here despite the rise in oil prices.

It looks like bears will have to remain on the defensive (for now).

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for

ChartDNA.com, and Product Development Manager for

FirstDerivatives.com. I also trade on

eToro and can be copied for free.