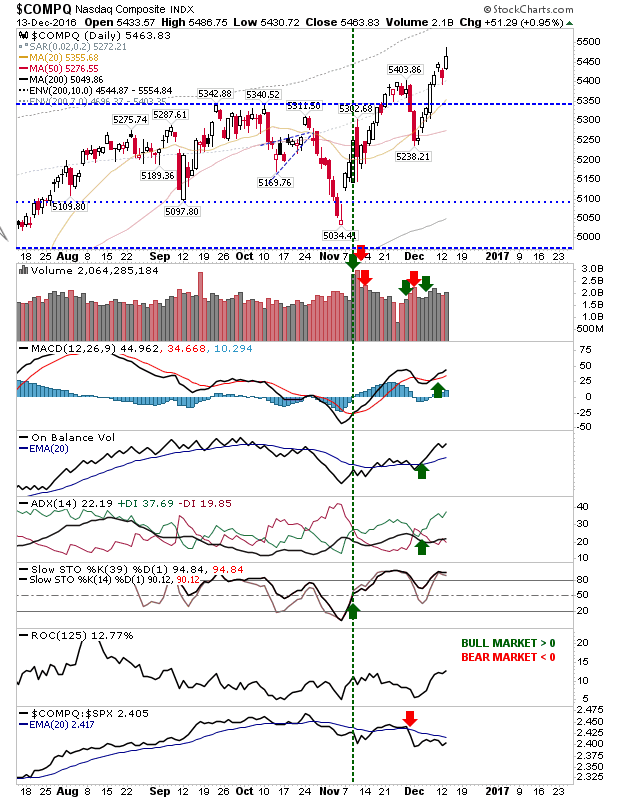

Buyers Jump the Gun - Nasdaq Soars

Well, that selling didn't last long. The Nasdaq powered higher as leading tech companies like Apple and Microsoft added over 1%. While the index does well remains a long way from tagging the upper band marking a profit taking opportunity, as had occurred in the Russell 2000 this month.

The S&P didn't quite get the Tech kicker, but it was a clear break above yesterday's selling doji. Technicals remain positive.

The Russell 2000 barely managed to challenge yesterday's selling, and remained near yesterday's lows. Profit taking remains the favoured action. The index is holding on to its relative out-performance, but this is likely to slip if current action continues - particularly as Tech and Large Caps continue to gain a strong footing.

The next step forward is to look for measured move targets across all indices, using the late November sell off as the pivot point for the drive higher. To calculate the measured move target, add the November high/low swing to the late November low, and project higher.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P didn't quite get the Tech kicker, but it was a clear break above yesterday's selling doji. Technicals remain positive.

The Russell 2000 barely managed to challenge yesterday's selling, and remained near yesterday's lows. Profit taking remains the favoured action. The index is holding on to its relative out-performance, but this is likely to slip if current action continues - particularly as Tech and Large Caps continue to gain a strong footing.

The next step forward is to look for measured move targets across all indices, using the late November sell off as the pivot point for the drive higher. To calculate the measured move target, add the November high/low swing to the late November low, and project higher.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

--- Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.