Second Day of Recovery Buying

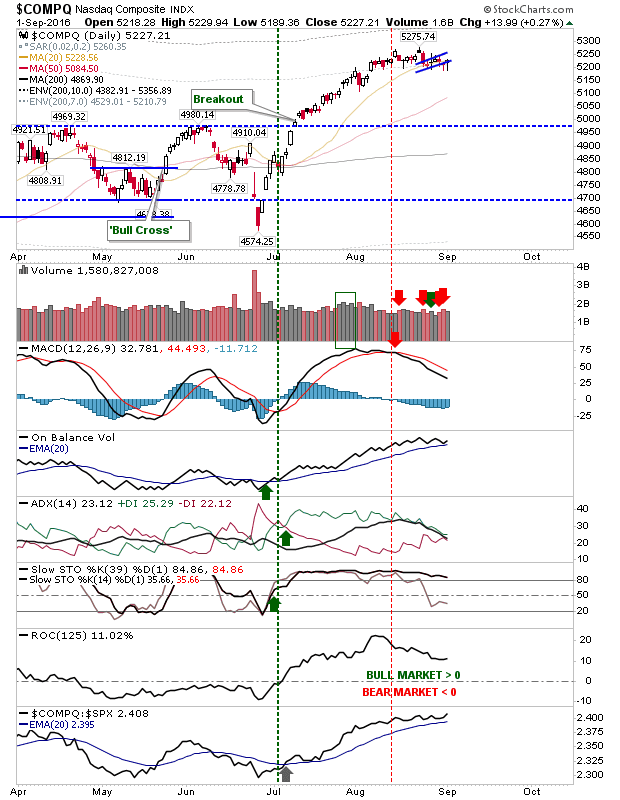

While there was little net change, intraday action is setting up nicely for bulls. Tomorrow's jobs data may be the catalyst to break markets from tight action and push to new highs.

Today's spike low in the Dow found support at its 50-day MA.

The Semiconductor Index did manage to post a gain as it traded along a tight trendline. While it's looking vulnerable to profit taking it hasn't given an inclination of doing so.

The Nasdaq should benefit from continued Semiconductor strength.

While the Russell 2000 finds support at its 20-day MA much like the Dow did at its 50-day MA

With weeks of nondescript action following Brexit volatility markets are ready for their move, but will tomorrow deliver the bullish reaction markets appear to be leaning towards?

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

Today's spike low in the Dow found support at its 50-day MA.

The Semiconductor Index did manage to post a gain as it traded along a tight trendline. While it's looking vulnerable to profit taking it hasn't given an inclination of doing so.

The Nasdaq should benefit from continued Semiconductor strength.

While the Russell 2000 finds support at its 20-day MA much like the Dow did at its 50-day MA

With weeks of nondescript action following Brexit volatility markets are ready for their move, but will tomorrow deliver the bullish reaction markets appear to be leaning towards?

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.