Meh Part II

The week started much like past week's finished with a whole lot of nothing. No volume, no action, no outlook.

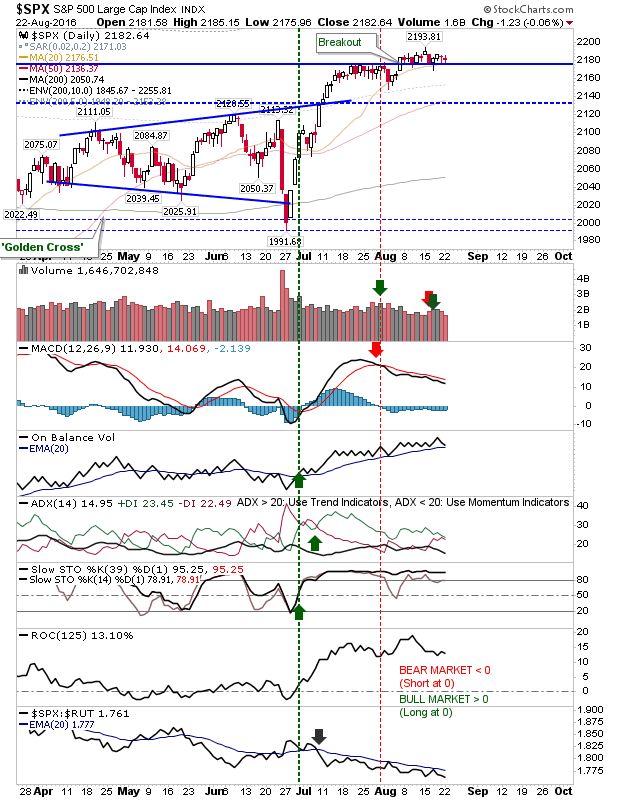

At least the S&P is holding breakout support. Watch for 'sell' triggers in +DI/-DI and On-Balance-Volume.

The Nasdaq managed to gain a little, waiting for traders to break it out of its range.

The Russell 2000 also made small inroads into last week's highs. Watch for recent relative underperformance against the Nasdaq to reverse, perhaps marking a new period of Small Caps leadership.

Can markets break their range? Jani was right picking his holiday for August...

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro,

register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

At least the S&P is holding breakout support. Watch for 'sell' triggers in +DI/-DI and On-Balance-Volume.

The Nasdaq managed to gain a little, waiting for traders to break it out of its range.

The Russell 2000 also made small inroads into last week's highs. Watch for recent relative underperformance against the Nasdaq to reverse, perhaps marking a new period of Small Caps leadership.

Can markets break their range? Jani was right picking his holiday for August...

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro,

register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.