Friday's Jobs Boost Holds

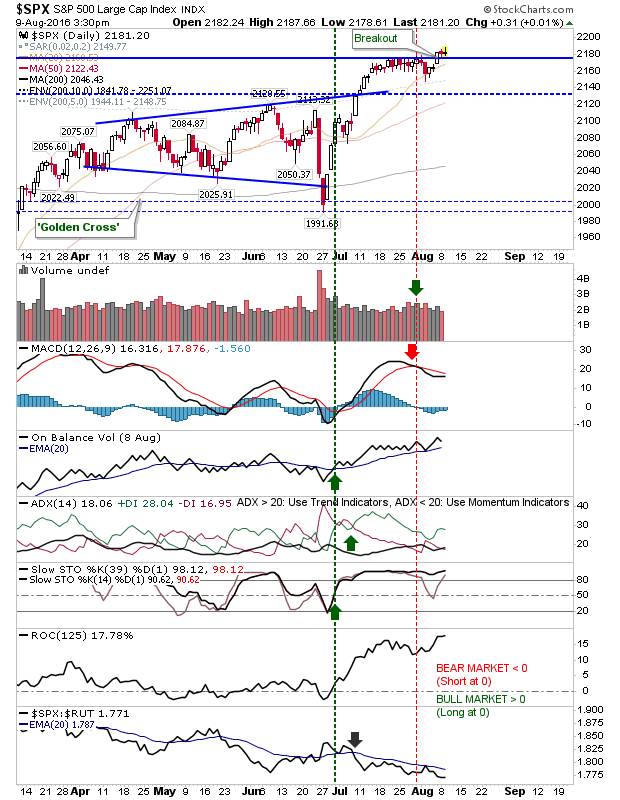

Getting back into the groove with my vacation behind me. Friday's jobs data gave markets a healthy boost into the weekend past to help reverse profit taking from last week. These gains have held for the early part of this week too, although with end-of-summer still a month away it's hard to see where the next boost will come from. Having said that, there isn't a reason to short, and taking some profits wouldn't hurt, but there is no clear sell signal either.

The S&P successfully navigated 2,100 in July and is building a new support level around 2,070. Technicals are drifting a little, but from a position of strong bullishness. Relative performance is perhaps the only concern, but this is only because Small Caps are in a more bullish state.

Speaking of Small Caps, the Russell 2000 is also dealing with a MACD 'sell' trigger like the S&P, and in its case is losing relative ground against the Nasdaq. Other than that, it looks healthy.

Market leading Nasdaq has posted steady gains without looking like it was getting ahead of itself. Outstanding relative performance and no technical 'sell' triggers leaves the index well positioned to continue its creep higher.

For tomorrow, watch for early profit taking. Shorts have little to look forward too unless last week's lows are broken, and even then it's going to take a few days to achieve.

I'll look to get my #sectobreadth analysis up over the coming days.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P successfully navigated 2,100 in July and is building a new support level around 2,070. Technicals are drifting a little, but from a position of strong bullishness. Relative performance is perhaps the only concern, but this is only because Small Caps are in a more bullish state.

Speaking of Small Caps, the Russell 2000 is also dealing with a MACD 'sell' trigger like the S&P, and in its case is losing relative ground against the Nasdaq. Other than that, it looks healthy.

Market leading Nasdaq has posted steady gains without looking like it was getting ahead of itself. Outstanding relative performance and no technical 'sell' triggers leaves the index well positioned to continue its creep higher.

For tomorrow, watch for early profit taking. Shorts have little to look forward too unless last week's lows are broken, and even then it's going to take a few days to achieve.

I'll look to get my #sectobreadth analysis up over the coming days.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.