Buyers Step Up

A respectable day for markets, unwinding much of the damage caused by Friday's selling. Volume was down, which softened the day's buying.

The S&P had the best of the action, which was a little against expectations for Tech/Semiconductors to drive the gain.

The Nasdaq only managed half the gain, but there was still a lingering weakness with some selling into the close. The 20-day MA is acting as supply.

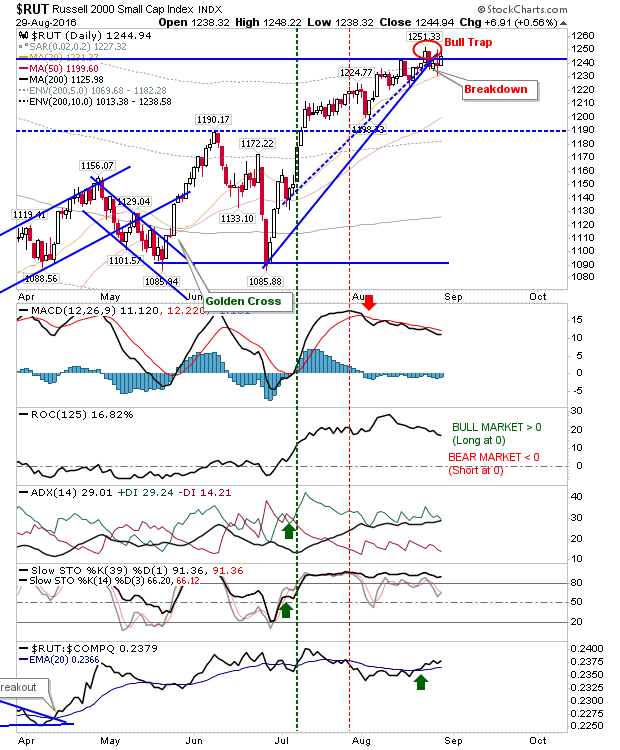

The Russell 2000 broke rising support on Friday and while it gained today it didn't do enough to recover the trendline break.

I haven't mentioned it much, but VXN volatility is looking like it's setting up for a spike move higher. Having said that, it did likewise in early 2013 and it spent the next two years moving sideways as the Nasdaq piled on the gains.

Tomorrow is a chance for bulls to press their advantage. However, there is need for some supporting volume.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P had the best of the action, which was a little against expectations for Tech/Semiconductors to drive the gain.

The Nasdaq only managed half the gain, but there was still a lingering weakness with some selling into the close. The 20-day MA is acting as supply.

I haven't mentioned it much, but VXN volatility is looking like it's setting up for a spike move higher. Having said that, it did likewise in early 2013 and it spent the next two years moving sideways as the Nasdaq piled on the gains.

Tomorrow is a chance for bulls to press their advantage. However, there is need for some supporting volume.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.