Respectable Finish To Week

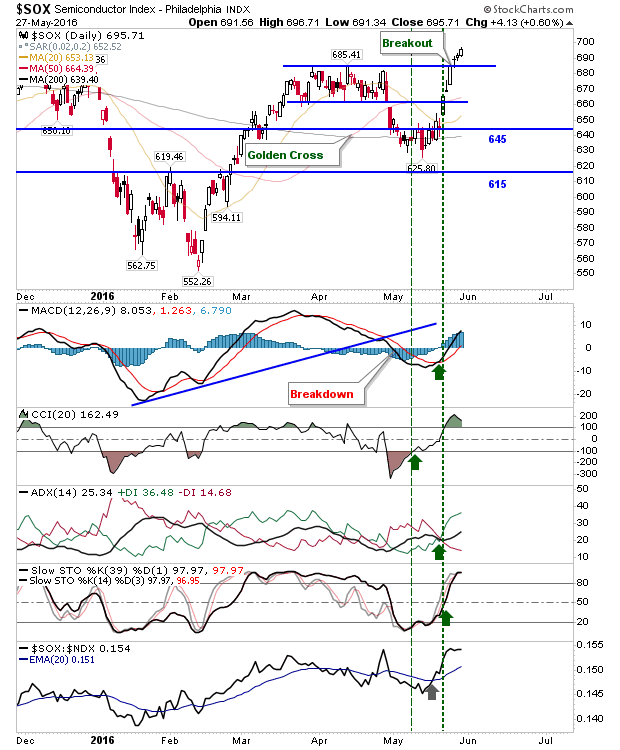

Semiconductors were the star of the week. The index cleared Match/April congestion and posted six consecutive winning days in a row. Technicals are all in the green and the index is above all key moving averages. Weakness will be a buying opportunity; a test of the 50-day MA would be a good start.

The Russell 2000 managed to regain the prior rising channel. Technicals are positive although it still has to make up relative ground against the Nasdaq. The index hasn't yet cracked new highs but one more days gain may be enough.

The S&P hasn't yet negated the head-and-shoulder reversal pattern, but with technicals net positive there is a good chance the last of the shorts will be squeezed out of it. Bears will be clinging to the relative underperformance of the index to Small Caps, but it's a small crumb of comfort and looking less likely to hold.

The Nasdaq is reaping the benefit of Semiconductor Index strength as tech based stocks gain a boost. The index is well placed to kick on and challenge late 2015 highs as May's consolidation looks to have provided a solid accumulation area for those who were able to take advantage.

The bank holiday weekend will offer bulls a welcome break. Next week is nicely set up for bulls and if Tuesday/Wednesday delivers a gain it will make it hard for any shorts to be holding their positions.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The Russell 2000 managed to regain the prior rising channel. Technicals are positive although it still has to make up relative ground against the Nasdaq. The index hasn't yet cracked new highs but one more days gain may be enough.

The S&P hasn't yet negated the head-and-shoulder reversal pattern, but with technicals net positive there is a good chance the last of the shorts will be squeezed out of it. Bears will be clinging to the relative underperformance of the index to Small Caps, but it's a small crumb of comfort and looking less likely to hold.

The Nasdaq is reaping the benefit of Semiconductor Index strength as tech based stocks gain a boost. The index is well placed to kick on and challenge late 2015 highs as May's consolidation looks to have provided a solid accumulation area for those who were able to take advantage.

The bank holiday weekend will offer bulls a welcome break. Next week is nicely set up for bulls and if Tuesday/Wednesday delivers a gain it will make it hard for any shorts to be holding their positions.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.